Within the first two months of 2024, Texas residents have reported nearly $500,000 lost to

investment scams to BBB Scam Tracker, with many reports detailing new promotional

tactics scammers are using that encourage investors to participate in the scheme. By

framing an investment opportunity with ‘New Year’ discounts on service, withdrawal, and

tax fees, some Texas residents have lost more than $100,000 and cannot recover their

funds. BBB’s 2023 Scam Tracker Risk Report found investment and cryptocurrency scams

are the No. 1 riskiest scam North American consumers encountered last year. 80% of people

who were targeted by this scam lost money with a median loss of $3,800.

Investment scams are not modern inventions, but many new technologies are making it

easier than ever for anyone to enter the investment scene, opening countless opportunities

for legitimate and fraudulent traders. Using the reach and engagement of social media, con

artists create highly engaging content and position themselves as an expert source of

information, capitalizing on confusing financial terms and unclear processes. Some of the

primary sources scammers use to find a potential target include:

Canvasing social media community groups that focus on investments or

cryptocurrencies and proactively contact people who ask questions.

Creating short-form video content that demonstrates their successes while investing,

often by showing large bundles of cash or a lavish lifestyle.

Establishing a romantic link with a target then directing them to an investment

opportunity, leaning heavily on flattery and disguising their true intentions under the

veil of an online relationship.

Using sophisticated systems designed to appear like legitimate investment dashboards,

scammers mislead their target into believing their initial investment is creating huge

returns. Encouraged by what they can see with their own eyes, investors listen to the

recommendations of the scammer to invest more of their money into the fraudulent fund

with many liquidating financial assets, taking out personal loans, or refinancing their homes.

The assumption is they’ll easily be able to recover once they withdraw their funds.

Unfortunately, when they attempt to withdraw their money, many victims learn that the

‘trader’ is a fraud.

After attempting to withdraw, investors may be charged a series of service, withdrawal, or

tax fees before the money is released to their accounts, and the rates of these charges do

not reflect the promotional offer used when they initially signed up for the service. When the

fees are paid, the scammer disappears with the remaining investment, access to the

dashboard is disabled, and many deactivate the social media accounts they used to initiate

contact. Alternatively, the scammer takes these actions immediately after the withdrawal

request is made without charging additional fees. In some of the costliest cases, the

scammer continually charges progressively higher fees to withdraw, claiming that the total

deposit in the fund must first meet a predetermined level before it can be accessed or that

additional services must be paid.

Consumer Reports:

Houston, Texas – January 2024

“[The trader] told me I could start investing with $200 and would get up to $2,000. He

would help set up my account and manage my trades [with] a 10% company fee off my

profits. I was told to send $200 to a Cash App account, and when the trade was supposedly

over, I was charged $575 to get my profits. When I paid that, I was told I needed to pay

$350 for IRS taxes. At that point, I did not pay any more money and told the person I was

going to report them. They deleted our conversation and blocked me.”

Cedar Park, Texas – February 2024

“They had a group on WhatsApp stating that they would teach you how to trade

cryptocurrency, and you can earn money from it using paired crypto contracts by setting up

an account and downloading a specific app. You can see your money growing in the account,

but once you try to request the funds, they tell you that you must pay a 33% tax fee to

receive the funds. I reluctantly paid it and still did not receive the funds. Eventually, they

told me that there was an error and that I would need to pay $500 to fix it. I stated that

this was a scam and was immediately removed from the group.”

Fort Worth, Texas – January 2024

“Initially approached off TikTok, they claimed there was a guaranteed investment growth of

15%. After the initial investment [of $3,000], I was hit with extortion when it came time to

withdraw the funds. They said I had to pay more to ‘unlock’ my funds to be transferred. I

did this hoping I wasn’t being scammed; I was wrong. They kept every dime I sent and then

ghosted me when I asked too many questions.”

To help Texas residents steer clear of investment scams, Better Business Bureau

recommends investors follow these guidelines:

Don’t fall for high-pressure or scare tactics. If a ‘trader’ contacts you, they may try to

convince you that you will only get high returns if you immediately invest in the fund. Be

wary of anyone using this type of language if you do not have a working relationship and

are confident they are legitimate. If you’ve already provided an initial investment, they may

threaten you with legal action if you do not pay additional fees. Recognize these signs as a

hallmark of a scam and avoid interacting with anyone who relies on high-pressure or scare

tactics.

Be skeptical of guaranteed returns. No legitimate trader can tell the future, and

unforeseen fluctuations in the market can make even the most stable funds have minimized

returns. Investing comes with an inherent risk, and scammers often try to encourage people

to enter the scene by guaranteeing a specific percentage or value that will be returned on

their investment. These tactics revolve around the get-rich-quick scheme and are another

example of – if it sounds too good to be true, it probably is.

Do your research. Especially when approached by someone unsolicited via social media,

take the time to research their name, business, or group online to see if anyone else has

encountered issues with them before. Check BBB Scam Tracker for consumer reports and

check if their company is listed, or Accredited, with the organization. BBB Accredited

Businesses are required to adhere to the organization’s Standards for Trust to maintain their

status, and one of the major elements of these standards is responsiveness.

Familiarize yourself with investment terms and processes. Consumers looking to

enter the investment scene are encouraged to familiarize themselves with standard

processes, terms, and systems to give them the knowledge they need to recognize

abnormal interactions. While it is unnecessary to become a financial expert, the ability to

speak conversationally about financial terms can help investors identify impostors and find

the right person for their needs.

If you’ve been a target of an investment scam, report your experience to Better Business

Bureau at BBB.org/ScamTracker. Information provided may prevent another person from

falling for these costly schemes.

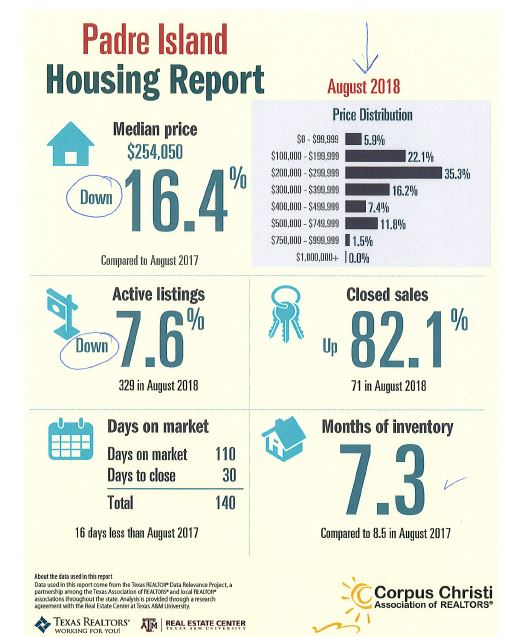

More shut-eye

More shut-eye Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Corpus Christi’s newly appointed water director knows a few things about fixing water system woes.

Corpus Christi’s newly appointed water director knows a few things about fixing water system woes.