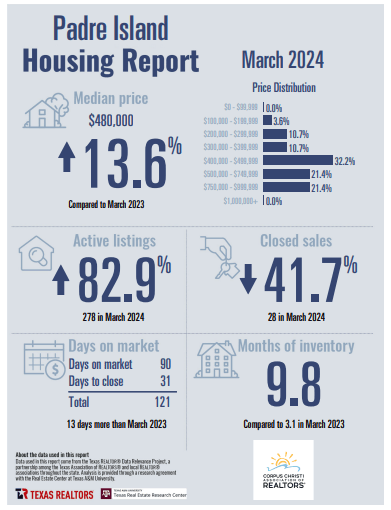

Corpus Christi Association of Realtors has posted the North Padre Island Housing Report for March 2024.

Our active listing median prices have risen the past month to $480,000 this past month which is an 13.6% decrease from where it was compared to last March at this time! CCAR shows us the data that is increasing for active listings by 82.9% with a total of 278 properties this past month while inventory Has risen at 9.8 compared to 3.1 last year at this time.

Days on the market for sale increased this past month with an average of 90 days and the highest categories for sales with 32.2% of all the sales being priced between $400,000 – $399,999. The market is still staying very stable so far into 2024 with properties available across many pricing areas. North Padre Island’s newest development Whitecap NPI is open for sales of their lots in Phase 1, Contact Coastline Properties Agent Ms. Amber Spicak at their office for all pre-sales. amber@coastline-properties.com

The consumer price index climbed 3.5% year over year in March, according to data released today by the Bureau of Labor Statistics, faster than February’s 3.2% pace. Economists surveyed by FactSet had expected an annual increase of 3.4%.

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!

They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

TWIA NEWS…….

TWIA NEWS……. It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes. You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.

You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection. With the flooding and other tragedies that have occurred across the state, it is important that consumers be aware of Chapter 57 of the Texas Business and Commerce Code that was enacted by HB 1711 effective September 1, 2011. The bill applies to contractors who remove, clean, sanitize, demolish, reconstruct, or otherwise treat improvements to real property as a result of damage or destruction to that property caused by a natural disaster. Specifically, it requires that a “disaster remediation” contract must be in writing and prohibits a “disaster remediation contractor” from requiring payment prior to beginning work or charging a partial payment in any amount disproportionate to the work that has been performed. However, the statute exempts contractors that have held a business address for at least one year in the county or adjacent county where the work occurs.

With the flooding and other tragedies that have occurred across the state, it is important that consumers be aware of Chapter 57 of the Texas Business and Commerce Code that was enacted by HB 1711 effective September 1, 2011. The bill applies to contractors who remove, clean, sanitize, demolish, reconstruct, or otherwise treat improvements to real property as a result of damage or destruction to that property caused by a natural disaster. Specifically, it requires that a “disaster remediation” contract must be in writing and prohibits a “disaster remediation contractor” from requiring payment prior to beginning work or charging a partial payment in any amount disproportionate to the work that has been performed. However, the statute exempts contractors that have held a business address for at least one year in the county or adjacent county where the work occurs. It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, and windstorm insurance. And in 2012, the Texas Department of Insurance (TDI) proceeded forward with several proposals to fund the Texas Windstorm Insurance Association (TWIA), the provider of last resort for windstorm insurance on our coast. It was then that TWIA adopted a 5% increase on all residential and commercial windstorm insurance policies to policyholders in the 14 counties (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy) comprising the Texas Coast. This was the third rate increase since 2009. But the long fight is finally over.

It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, and windstorm insurance. And in 2012, the Texas Department of Insurance (TDI) proceeded forward with several proposals to fund the Texas Windstorm Insurance Association (TWIA), the provider of last resort for windstorm insurance on our coast. It was then that TWIA adopted a 5% increase on all residential and commercial windstorm insurance policies to policyholders in the 14 counties (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy) comprising the Texas Coast. This was the third rate increase since 2009. But the long fight is finally over.