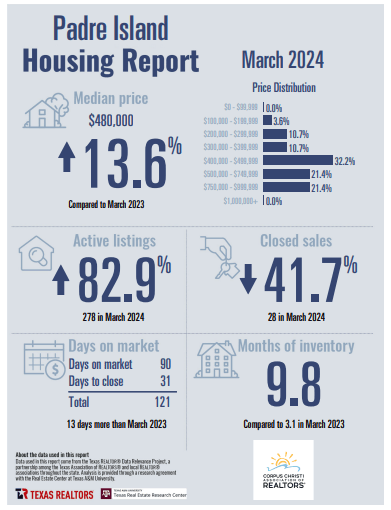

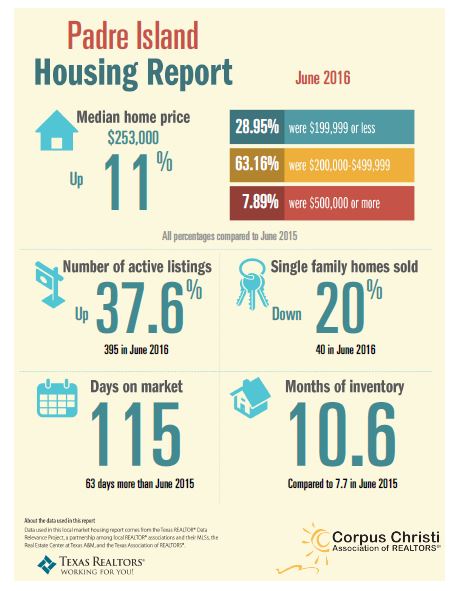

Corpus Christi Association of Realtors has posted the North Padre Island Housing Report for March 2024.

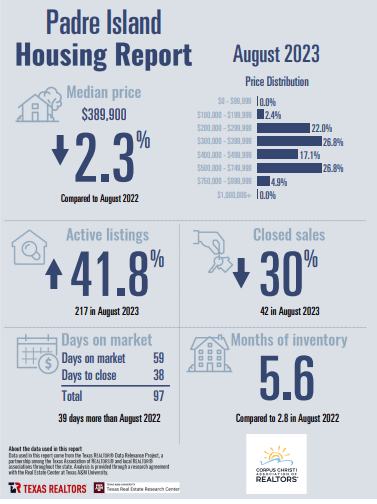

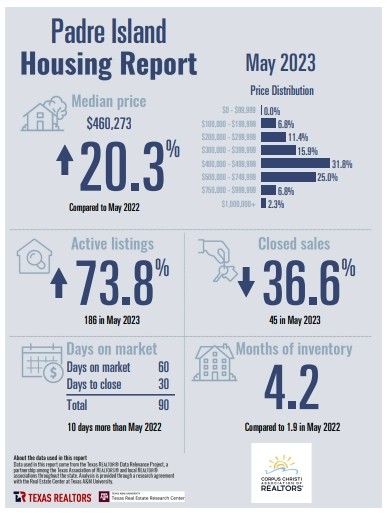

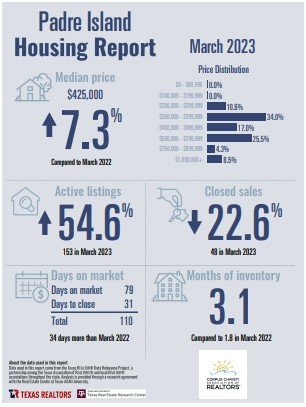

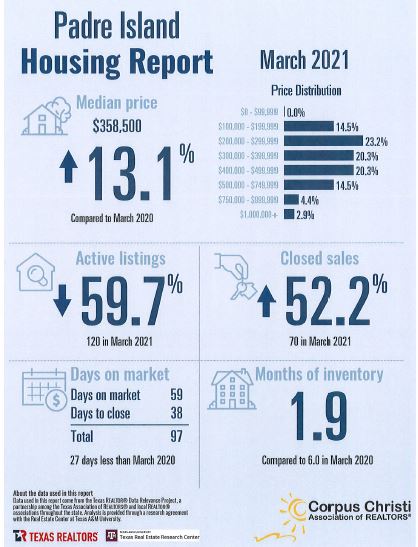

Our active listing median prices have risen the past month to $480,000 this past month which is an 13.6% decrease from where it was compared to last March at this time! CCAR shows us the data that is increasing for active listings by 82.9% with a total of 278 properties this past month while inventory Has risen at 9.8 compared to 3.1 last year at this time.

Days on the market for sale increased this past month with an average of 90 days and the highest categories for sales with 32.2% of all the sales being priced between $400,000 – $399,999. The market is still staying very stable so far into 2024 with properties available across many pricing areas. North Padre Island’s newest development Whitecap NPI is open for sales of their lots in Phase 1, Contact Coastline Properties Agent Ms. Amber Spicak at their office for all pre-sales. amber@coastline-properties.com

The consumer price index climbed 3.5% year over year in March, according to data released today by the Bureau of Labor Statistics, faster than February’s 3.2% pace. Economists surveyed by FactSet had expected an annual increase of 3.4%.

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!

Did you know?

Did you know?

Padre Island Corpus Christi

Padre Island Corpus Christi Bang for your buck

Bang for your buck

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie!

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie!

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.

You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.