BBB Tip: Recovering from freezing temperatures while avoiding unethical contractors and utility impostors

Over the weekend, plummeting temperatures and wintry weather mixtures have struck

communities across Texas, with many residents experiencing power outages, ruptured water

lines, hail damage, fallen tree limbs, or other issues due to below-freezing temperatures. As

home and business owners begin to thaw out in the coming days, many will discover a

variety of problems resulting from the sudden cold snap. While some homeowners can

easily handle cleanup and repair efforts, others will likely require the help of a professional.

Additionally, other residents may begin to piece together facts and receipts to learn they

interacted with an impersonated utility company that demanded immediate payment or a

fraudulent online seller advertising winter weather and emergency products.

After significant weather events that are likely to result in property damage, Better Business

Bureau typically receives an increase in reports of unethical contractors operating across

affected regions. Commonly referred to as ‘storm chasers,’ many businesses offering

services to residents negatively impacted by severe weather are well-respected and

legitimate. However, among these groups are those who would take advantage of a

homeowner in need rather than provide any meaningful service.

Some common issues reported to BBB in these types of situations include:

The contractor requires a significant deposit (over 50% of the total estimate) from

the property owner and then continually postpones the start date until

communication stops. Any effort by the homeowner to contact the business is

unsuccessful, and the business’s physical location is either too distant to travel to,

abandoned, a residential home for sale, or a vacant lot.

The homeowner is approached by a contractor who claims they have excess material

left over from a nearby project, and the business can pass the savings on to the

homeowner if they can start work immediately. Once the contractor begins the

project, the scope of work expands far beyond what was initially estimated, and the

homeowner is held accountable for paying a final bill that is significantly more

expensive than they expected.

Repairs on systems requiring specialized work (plumbers, electricians, HVAC

technicians, etc.) are done by an unlicensed individual, leaving the homeowner liable

if the contractor did not do the repairs correctly or did not comply with the applicable

housing codes.

Property owners are encouraged to verify that the provided licenses are valid by checking

with the appropriate regulatory agency. In Texas, the Texas Department of Licensing and

Regulation and the Texas Department of Agriculture are two of the most likely agencies that

hold licenses for businesses that property owners may call upon to help recover from

freezing temperatures.

Decreasing temperatures also allow utility scammers to take advantage of people’s fears of

being without heat during the cold weather. Be wary of texts, phone calls or emails from the

utility company that services your area claiming that they will shut your heat off

immediately unless an outstanding bill is paid. According to the Public Utility Commission of

Texas, an electric utility company cannot disconnect a customer anywhere in its service area

on a day when:

The previous day’s highest temperature did not exceed 32 degrees Fahrenheit, and

the temperature is predicted to remain at or below that level for the next 24 hours,

according to the nearest National Weather Service (NWS) reports.

TWIA NEWS…….

TWIA NEWS……. With the flooding and other tragedies that have occurred across the state, it is important that consumers be aware of Chapter 57 of the Texas Business and Commerce Code that was enacted by HB 1711 effective September 1, 2011. The bill applies to contractors who remove, clean, sanitize, demolish, reconstruct, or otherwise treat improvements to real property as a result of damage or destruction to that property caused by a natural disaster. Specifically, it requires that a “disaster remediation” contract must be in writing and prohibits a “disaster remediation contractor” from requiring payment prior to beginning work or charging a partial payment in any amount disproportionate to the work that has been performed. However, the statute exempts contractors that have held a business address for at least one year in the county or adjacent county where the work occurs.

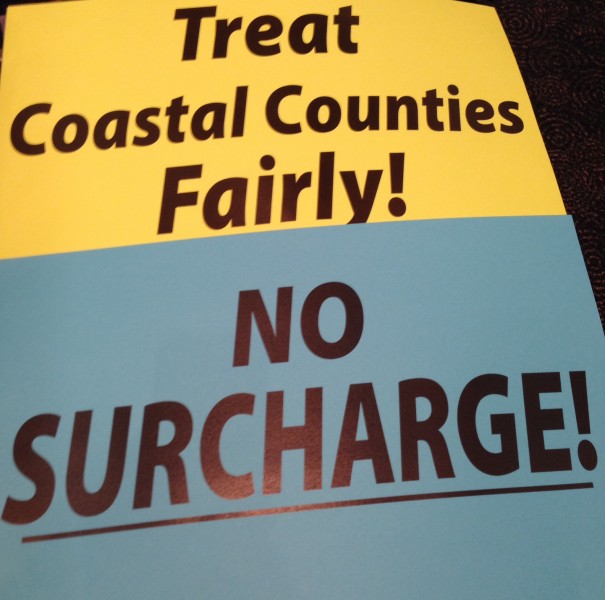

With the flooding and other tragedies that have occurred across the state, it is important that consumers be aware of Chapter 57 of the Texas Business and Commerce Code that was enacted by HB 1711 effective September 1, 2011. The bill applies to contractors who remove, clean, sanitize, demolish, reconstruct, or otherwise treat improvements to real property as a result of damage or destruction to that property caused by a natural disaster. Specifically, it requires that a “disaster remediation” contract must be in writing and prohibits a “disaster remediation contractor” from requiring payment prior to beginning work or charging a partial payment in any amount disproportionate to the work that has been performed. However, the statute exempts contractors that have held a business address for at least one year in the county or adjacent county where the work occurs. It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, and windstorm insurance. And in 2012, the Texas Department of Insurance (TDI) proceeded forward with several proposals to fund the Texas Windstorm Insurance Association (TWIA), the provider of last resort for windstorm insurance on our coast. It was then that TWIA adopted a 5% increase on all residential and commercial windstorm insurance policies to policyholders in the 14 counties (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy) comprising the Texas Coast. This was the third rate increase since 2009. But the long fight is finally over.

It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, and windstorm insurance. And in 2012, the Texas Department of Insurance (TDI) proceeded forward with several proposals to fund the Texas Windstorm Insurance Association (TWIA), the provider of last resort for windstorm insurance on our coast. It was then that TWIA adopted a 5% increase on all residential and commercial windstorm insurance policies to policyholders in the 14 counties (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy) comprising the Texas Coast. This was the third rate increase since 2009. But the long fight is finally over.