It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, windstorm insurance, etc. But it could get worse. The Texas Department of Insurance (TDI) may be adding surcharges to existing rate policies that could greatly increase insurance costs for our Coastal Bend residents in these 14 coastal counties: Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson,

Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy.

Perhaps it’s because we haven’t had a catastrophic event since Hurricane Celia in 1970, but in the event of hurricane damage that exceeds the amount the Texas Windstorm Insurance Association (TWIA) can pay, all of the below policy holders will be assessed a yet unspecified amount of money.

- Auto policy

- Motorcycle policy

- Recreational vehicle policy

- Boat policy

- Homeowners policy

- Windstorm policy

- Renter’s insurance policy

- Commercial building policy

- Fire and allied lines

- Farm and Ranch owners

What really stings here is this: when hail or tornadoes pummel other parts of Texas,funding from our coastal counties goes toward aid. But what about if our coast gets hit with a hurricane? It’s on us and us alone to pay for the damages. This is making many of our residents scratch their heads.

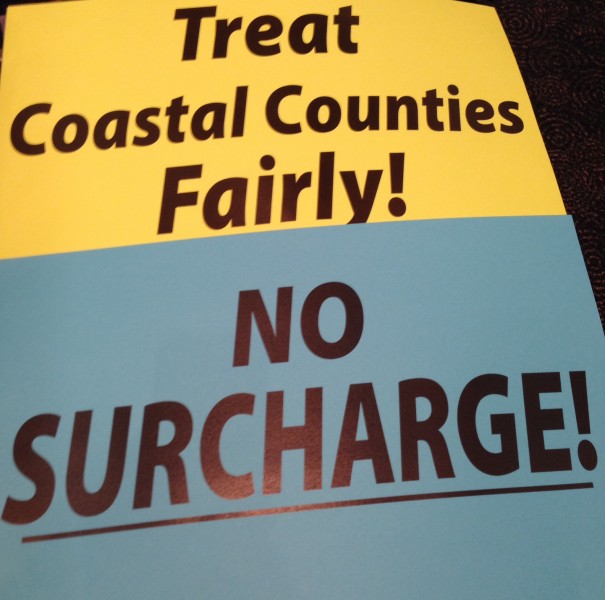

On March 5, over 400 residents came to a public hearing the city held at Texas A&M for our residents to voice their opposition to the proposed “tax,” as Representative Todd Hunter referred to it. Below are some of the arguments made during the hearing:

State Senator Juan “Chuy” Hinojosa commented on the misconception that all coastal residents are rich. In reality, we’re just like the rest of working America, where many of us can’t afford to pay much more.

State Representative Todd Hunter expanded upon this idea, calling the surcharge a discrimination on the minority population of the 14 coastal counties. He pointed out that the TWIA website specifically states that they do not discriminate against geographical locations, which is exactly what this surcharge s. Before any surcharge law is passed, Representative Hunter suggests doing an economic analysis on the minority groups affected.

Mayor Nelda Martinez explained this surcharge would have a burdensome affect on the momentum of our community, and that an increase in insurance over the past 14 years will economically sink these 14 counties. She wrapped it up by saying “Mother nature doesn’t discriminate…”

JJ Johnson with TPCO American noted that with all the new big plants coming to Corpus (TPCO, Cheniere Energy, M&G Chemicals, Schlitterbahn…) there will be thousands of workers, too. We need to ensure that our new laborers on blue-collar salaries can afford to live here.

This surcharge could add up to hundreds, maybe even thousands of dollars extra per person per year. At the Corpus Christi Association of Realtors luncheon at the Corpus Christi Town Club on March 13, Representative Hunter explained that they will probably pass the rule, but they may be hesitant to enforce it. He promises to “fight them forever.”

The general consensus seems to be that our coastal residents should not pay these surcharges. Or, at the very least, spread the cost evenly across the state. As it turns out, there’s been a conclusion since 2009, but only now will this law be put into effect. After Hurricane Ike hit, the Insurance Council of Texas approved these surcharges,

given any subsequent hurricane damage exceeding $1 billion dollars. Here’s to testing our luck!