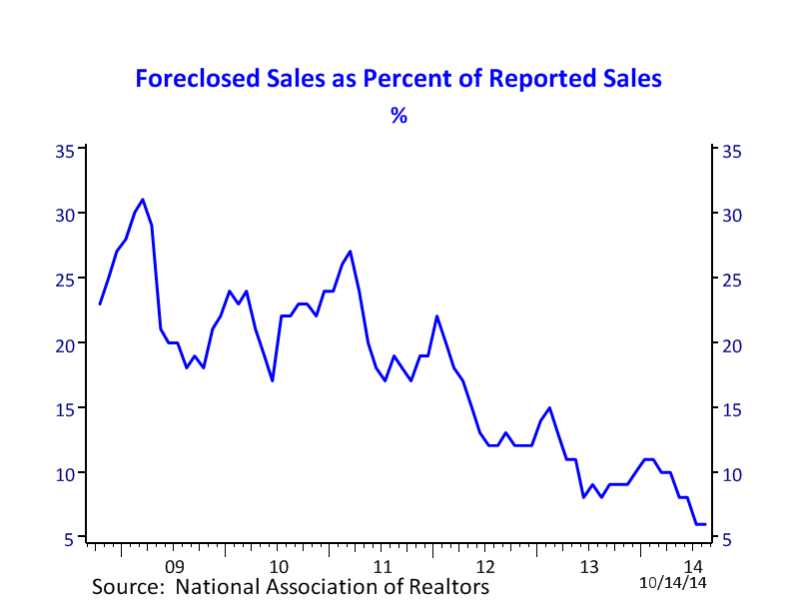

The number of foreclosed home sales has been rapidly falling and could essentially vanish by next year. Those who specialize in foreclosure sales should therefore look towards other line of business.

- In August, foreclosed sales comprised only 6 percent of all home sales transactions, down from double-digit figures last year and from near 30 percent few years further back.

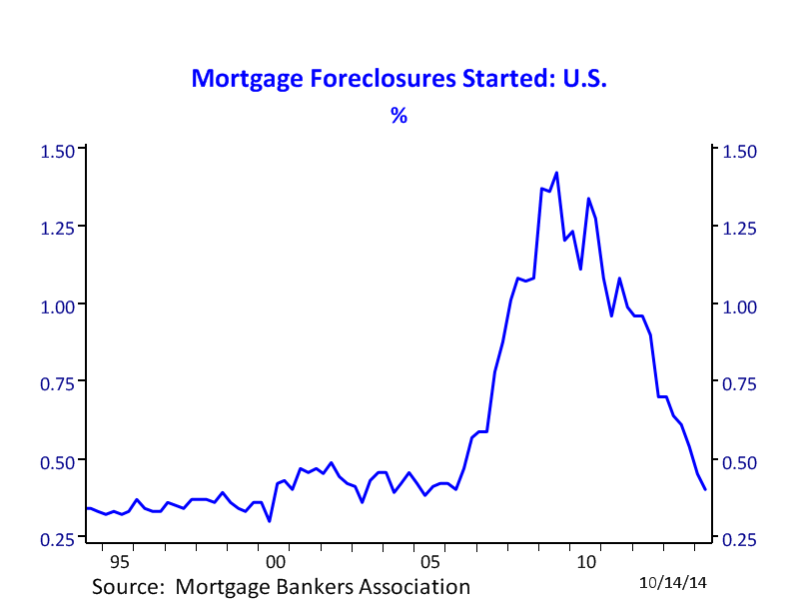

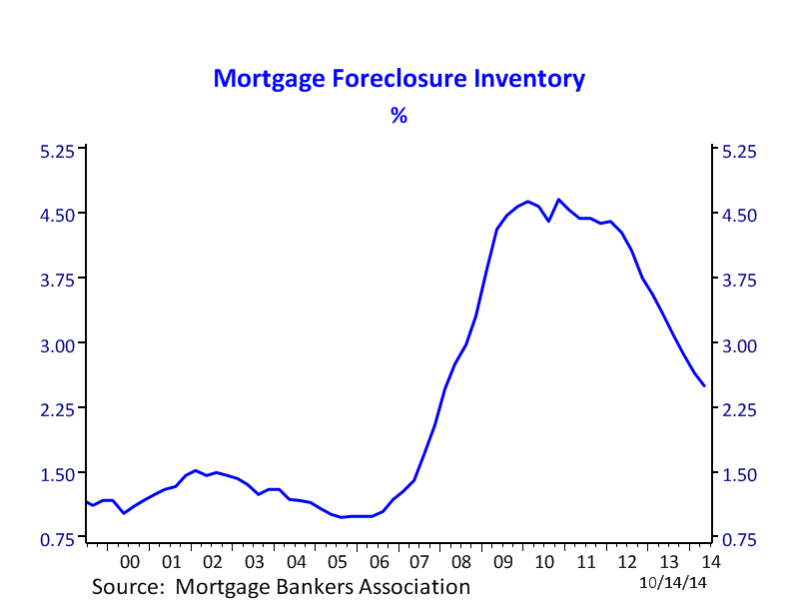

In addition to fewer distressed properties on the market currently, there is very little in the pipeline. The number of foreclosure starts is essentially back-to-normal with only 0.4 percent of mortgages undergoing that process. Moreover, mortgages originated in the past four years are one of the best performing with very little defaults.

- We should nonetheless be mindful that the overall count of seriously delinquent mortgages and those homes in some stage of foreclosure process are still above historical normal because some states have been very slow to process the required paper work. For example, some homeowners who have not been paying mortgages for 2 or 3 years are still living in the home in Florida and New Jersey. But the broad figure on seriously delinquent borrowers has been sliced in half over the past three years.

The bottom line there is that foreclosed sales could be in the 1 to 3 percent next year – essentially back the normal market conditions. Fewer distressed properties will also help with the overall appraisal process of not using bad comparable.

- REALTOR business tip. From time-to-time there will be a homebuyer who takes a very long time to decide. After viewing 30 homes, they will ask for few more, and on and on. One way to help on the decision, according to psychology studies on human behavior, is to provide extreme alternatives that the consumer will certainly not buy. For example, showing a home that is outside of the buyer’s price criteria or a foreclosed home can help speed the decision. Since foreclosed homes are on the decline, one has to use other alternative extreme comparisons.

- A similar decision process applies in politics. Research shows undecided voters wanting to gravitate towards the middle for no other reason than not wanting to be extreme. Therefore a portrayal of political opponent as an extremist will help get votes for your candidate. That is why negative political advertisements, though nasty and unpleasant to view, is said to work in helping undecided voters make up their mind.

Source: National Association of Realtors