If you are looking to Purchase or List a home on Padre Island…Ask for the ONLY Padre Island EXPERTS!

If you are considering property in Corpus Christi, the most affordable properties are located on Padre Island. Padre Island has the most affordable waterfront properties around. We sit on the warm Gulf of Mexico with miles of beaches and that isn’t including the long sandbar islands of Port Aransas and San Jose Island.

Many savvy real estate investors have retired early in their lives by investing in some of the best real estate markets on Padre Island. Our real estate market offers an excellent mix of opportunities such as catering to the student market from the college, military market at our base and our tourism market.

Our local economy and demographics makes Padre Island housing market incredibly stable, insulating from wild price swings while guaranteeing decent returns. Whether buying an investment property or wanting to own an owner-occupied home…Coastline Properties can answer your questions. whether you are a beginner or a seasoned pro you probably realize the most important factor that will determine your success is a working with a seasoned local real estate company.

Coastline Properties has been on the Island since 1995. We strive to set the standard in our industry and inspire others by raising the bar on providing exception real estate knowledge and savvy!

Come Coast Awhile……right here!

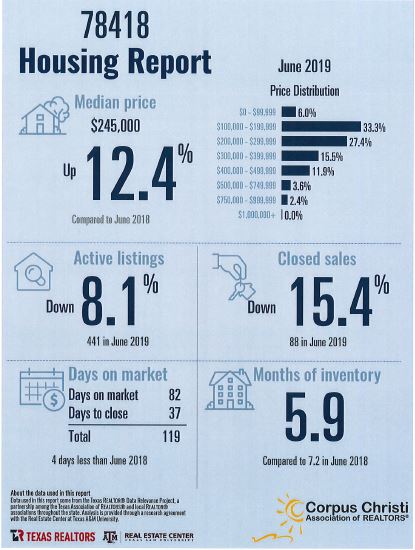

Padre Island June 2019 Data (Click Pic below for PDF)