Many homeowners are making difficult decisions on whether it’s a good time to sell or not. After all, home appreciation has risen tremendously over the past year, and the temptation may be stronger than ever.

Homeowners typically sell their homes after 16 years, according to U.S. Census Bureau data. About 20.2 million homeowners have purchased their home in the last 10 to 19 years, which would mean many of them may be feeling that desire to move, notes the National Association of REALTORS® Economists’ Outlook blog.

“Although the market typically slows down in fall, there is still stiff competition among buyers, with multiple offers for each home due to low inventory,” writes Nadia Evangelou, NAR’s senior economist and director of forecasting, on the association’s blog. “As a result, sellers continue to have strong negotiating power as most of them are able to sell their home for higher than the asking price.”

Homebuying activity remains strong this fall, even if reports do indicate it has slowed somewhat from the ultra-busy summer. Buyer demand continues to outpace supply. Eighty-seven percent of homes sold in August were on the market for less than a month, according to NAR data.

Also, for home sellers who also have to buy, they can still take advantage of historically low mortgage rates. Rates are expected to rise over the next year. Last week, the 30-year fixed-rate mortgage averaged 3.05%, according to Freddie Mac.

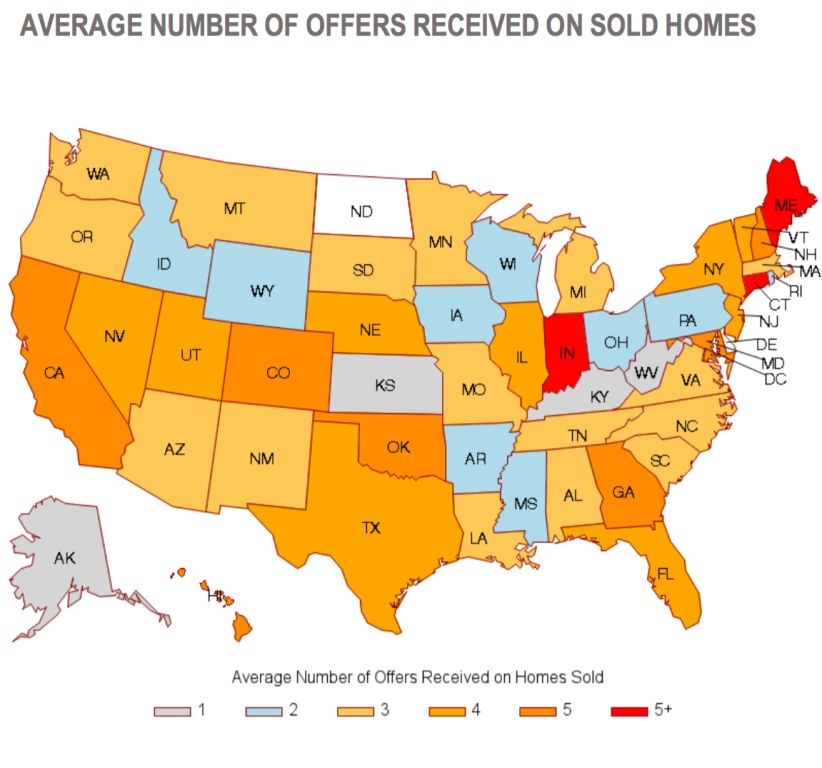

Bidding wars are still occurring too. About four offers were received on each closed home sale in August, according to real estate professionals surveyed for the REALTOR® Confidence Index survey for August.

Source: REALTORS® Confidence Index Survey, August 2021

A recent report on HomeLight says that certain homeowners especially should consider selling now, like those desiring to trade up and wanting to lock in a low mortgage rate; those who are looking to maximize retirement funds; and homeowners who have a current house that may need some work (seller’s markets tend to offer homeowners negotiation leverage in repairs).

Stacey Glenn, a real estate professional in Fort Myers, Fla., told HomeLight that it may cost home buyers about 10% to 20% more to purchase a home than a year ago, but buyers can still come out ahead in the long run, if they remain financially stable and stay in the house long enough for market appreciation.

On the other hand, HomeLight points out that homeowners may not want to sell if they recently refinanced their home; can’t afford current housing prices; or haven’t built up much equity yet.

Article Source National Association of Realtors