Press Release Sent Out on Behalf of State Representative Todd Hunter February 18, 2021

Corpus Christi Homes | Real Estate | Padre Island Rentals

Corpus Christi Real Estate | Padre Island Rentals | Property Management

Press Release Sent Out on Behalf of State Representative Todd Hunter February 18, 2021

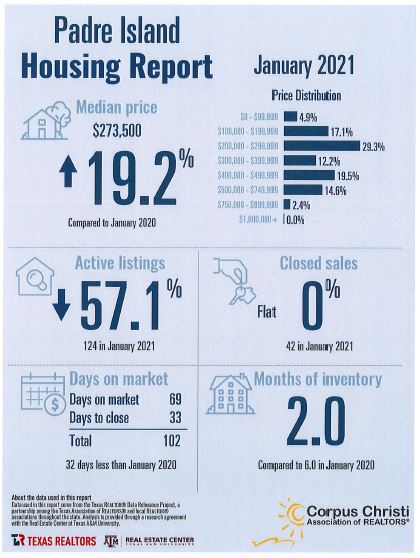

Days on the market for sale has decreased to an average of 69 days on the market. 29.3% of all the sales in November were priced between $200,000 – $299,999. The market is certainly remaining strong and it’s a great time to find that dream home you have been waiting for or cash out that equity. We are here to serve all your real estate needs.

When you look at interest rates there are so many advantages right now, let us share with you what Texas Real Estate is showing right now. Average U.S. mortgage rates started 2021 near historic lows and have hovered in that vicinity through January. That news has reached and encouraged buyers and sellers alike,this can seriously benefit your bottom line can provide valuable context for a homebuying decision.

The average rate for a 30-year fixed-rate mortgage was 2.77% as of January 21, according to Freddie Mac. The average was 3.62% in January 2020 and 4.46% in January 2019, 85 basis points and 169 basis points higher, respectively than the current rate. A buyer who purchases a $300,000 home at the average rate today would save just over $100,000 during the mortgage term compared to purchasing the same home two years ago—and the monthly payment would be almost $200 less.

Limited housing supply and low mortgage rates have contributed to increased competition and home prices, but the cost of borrowing money for a home is currently so low that buyers may be able to afford more than they would have one or two years ago.

Monthly mortgage rate averages stretching back to 1971 are available in MarketViewer (texasrealestate.com login required), the powerful data and market statistics tool available exclusively to Texas REALTORS® members. What a significant market advantage this is creating for all parties!

| Mon | Tue | Wed | Thu | Fri | Sat |

| +84° | +82° | +83° | +84° | +83° | +81° |

| +78° | +78° | +78° | +78° | +78° | +78° |

Coastline Properties ·14717 S Padre Island Dr, Corpus Christi, TX 78418 · 361-949-0101