It has been roughly a year since the COVID-19 pandemic began in the United States, and more people than ever are buying residential real estate in vacation housing markets.

In a study of counties that have seen the largest uptick of homebuyers and subsequently, home value – the top 10 are all in either vacation destinations or relatively affordable areas of big cities. That’s in line with the country’s sweeping work-from-home mandates put in place last March, which allowed millions of people with the capital to buy a property realizing they could work – and live – anywhere.

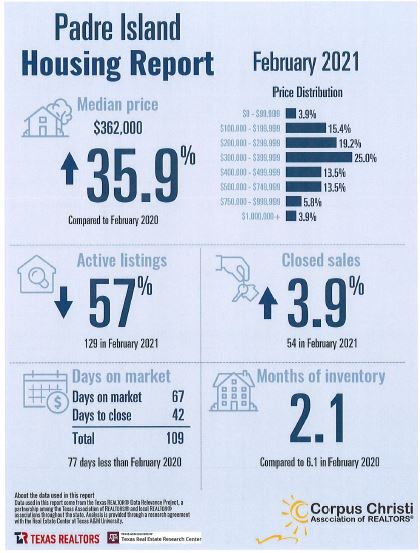

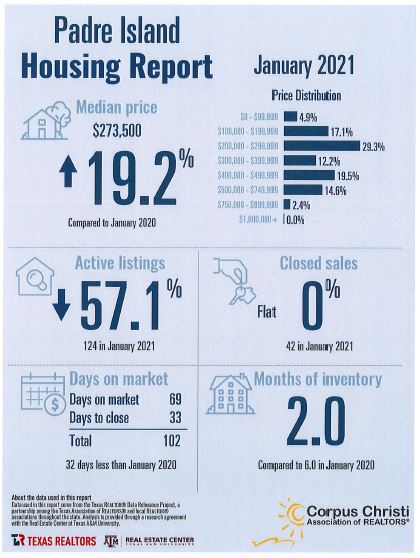

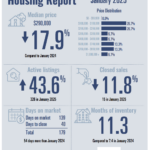

A demand for second homes across the country has skyrocketed since last January. What remains to be seen is how the continued vaccine rollout and expected economic stimulus checks impacts the larger metro areas’ housing markets. With most people receiving immunizations from COVID-19, more workplaces opening up to their employees – in turn, drawing them back to the city to avoid commuting from suburbs and vacation areas such as Padre Island and Port Aransas.

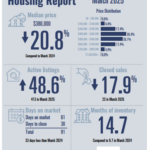

Mortgage rates continue to increase as the economy improves with the labor market and vaccinations continuing to roll out and additional stimulus spending. Even as mortgage rates rise modestly, the housing market remains healthy on the brink of spring home-buying season.

Homebuyer’s demand is strong, and for homeowners who have not refinanced but are looking to do so, they have not yet lost the opportunity. Cash-out refi’s have exploded. Many economists expect home prices to keep growing.

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!