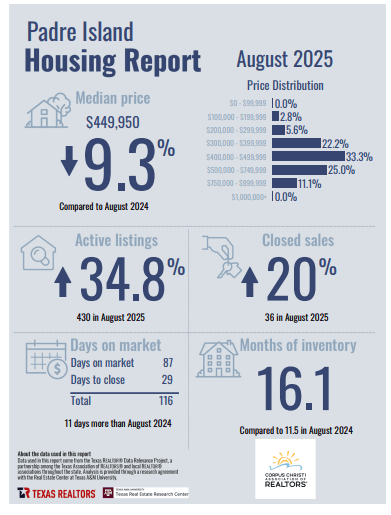

Corpus Christi Association of Realtors has posted the Padre Island Corpus Christi Housing Report for August 2025.

Our active listing median prices have risen the past month to $449,950 which is actually a 9.3% decrease from where it was compared to last August at this time! CCAR shows us the data that has increased for active listings to 34.8% with a total of 430 properties this past month compared to August 2024 while inventory rose to 16.1 compared to 11.5 last year at this time.

Days on the market has declined this past month with an average of 87 days and the highest categories for sales with 33.3% of all the sales being priced between $400,000 – $499,999. The August 2025 U.S. Consumer Price Index (CPI) showed an annual increase of 2.9%, up from the previous month’s 2.7% and the fastest pace of inflation since January. Month-over-month, the “all items” index rose 0.4%. Core inflation, which excludes volatile food and energy prices, rose 0.3% in August and 3.1% over the past year

In August 2025, Padre Island had a 16.1 month supply of properties FOR SALE. The BUYER’s market continues, they are some fantastic deals out there right now!

Padre Island’s newest development Whitecap NPI is open for sales of their lots in Phase 1, Contact Coastline Properties Agent Ms. Amber Spicak at their office for all pre-sales. amber@coastline-properties.com

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island Corpus Christi real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!