Anyone else sit at home and blast Jimmy Buffet radio through the surround sound? Mailbox Money is one of my personal favorites. He’s got the right idea: Invest in a piece of paradise, rent it, make (more than) a few bucks! With the housing market being as strong as it is right now, most buyers are losing out on the rat race – they WANT to be here, but (1) cannot afford to buy in this high seller’s market; (2) are attempting to purchase but continue to not be “the chosen one” in the multiple offer scenarios presenting with most properties for sale; (3) are unsure as to how long they’ll be able to spend away from their homestead; or (4) just want to get a feel for the Island before purchasing themselves.

These folks want to RENT! They want to give YOU their MONEY!

Spring and Summer are often pique times to consider selling and buying, especially now with the population AND popularity of the Coastal Bend rapidly increasing. Demand is HIGH and for good reason. Travel is becoming increasingly more accessible, and many are still working remotely and want to do so from our Island. Two really huge reasons to jump in and both buy and sell while the flocks are flocking.

So WHAT makes real estate such a powerful investment, not only now in the current market, but long-term?

WHAT:

If checking that mailbox for a monthly check is what has your face morphing into the heart eye emoji, then you’re asking yourself, “what are the elements of value to an investor?” Well, that depends on commitment: Do you intend on having a long-term or short-term investment? You also need to do your due diligence on rental rules – single-family homes must have a 30+ day minimum; however, most condos will allow vacation rentals. Ask your agent for the specifics on each property you have your eye on to ensure it aligns with your goals.

Property values and their projected appreciation may play a large role in your (a buyer’s) intentions. This past year is a prime example of how quickly appreciation can happen – and may likely continue on that upward trajectory. Tax depreciation, capital gains, and inflation hedge may also play a role in values. As important as these matters are, they may be a little snooze-worthy. So let’s make it quick.

Let’s take a look at each of these potential advantages:

Projected Appreciation: This is a percentage that estimates what your property will be worth in the future. Of course, nothing is ever promised, but the numbers could aid in the decision process.

Tax Depreciation: COULD help you maximize your tax savings. This is the depreciation that can be listed as an expense on a tax return, the gradual charging to expense of a fixed asset’s cost over its useful life.

Capital Gains: Another key tax advantage of owning an investment property. Capital gains on investment real estate is the difference between the sales price and the cost of purchase and improvements. They’re taxed at either a short-term rate or a long-term or reduced rate.

Inflation Hedge: This has to do with the rent that’s charged to the tenant. Some leases have provisions for rent increases to be indexed to inflation. In other cases, rental rates are increased whenever a lease term expires and the tenant is renewed. Either way, real estate income tends to increase faster in inflationary environments, allowing an investor to maintain its real returns.

Selling: When rental properties are sold, the proceeds can be rolled into other rental properties without paying capital gains taxes. This is called a 1031-Tax Exchange.

Now, most of you are probably thinking “This sounds great, but I can’t afford that…” Fortunately for many of us, you don’t have to be a part of the ultra-rich to own an investment property! After all is said and sold, as long as your rental income exceeds your monthly expenses, you WIN!

Here are some helpful tips that may guide you in the right direction:

- Work with an agent who is knowledgeable about the area. Here in our Coastal Bend, most agents are accustomed to working with investors/second home buyers.

- Know what the seller’s main goals are. That alone will give you a leg up on any offer you send their way. If they’re money-driven, offer over the asking price. If they need a long close and a lease-back, offer that. Extra Earnest Money? You get the idea.

- Spend time doing your research and asking your agent the property questions. Which is the right neighborhood for your needs, the costs of maintenance, HOA dues, taxes, insurance, etc.

- Have money. This may seem obvious but daunting, so let me explain that it doesn’t mean millions in the bank. Paying cash may give you a leg up, but many buyers will need a loan – your lender’s underwriter needs to see that you have adequate reserves (as often your down payment will be larger for a second property).

- Consider your debt-to-income ratio. It cannot be too high.

If you are at all capable, dive in. The options and advantages can far outweigh the fear of dabbling in real estate investing. If you live here, you know the magic of the Island – now is the time to capitalize on the growing rental market. Let not “checking the mail” be a chore – Cash in!

Helter swelter, you could fry an egg on the sidewalk! Eat the egg, but don’t BE the egg. If you follow these 10 tips, you may actually find that there are ways to enjoy the dog days of summer. Our bodies, moods, and bills take a toll during the scorching summer heat, but don’t let the temperature and humidity keep you from the beach, outdoor entertaining, and boating. Stay cool, my comPADREs.

Helter swelter, you could fry an egg on the sidewalk! Eat the egg, but don’t BE the egg. If you follow these 10 tips, you may actually find that there are ways to enjoy the dog days of summer. Our bodies, moods, and bills take a toll during the scorching summer heat, but don’t let the temperature and humidity keep you from the beach, outdoor entertaining, and boating. Stay cool, my comPADREs.

Padre Island Corpus Christi

Padre Island Corpus Christi Bang for your buck

Bang for your buck

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie!

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie! They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

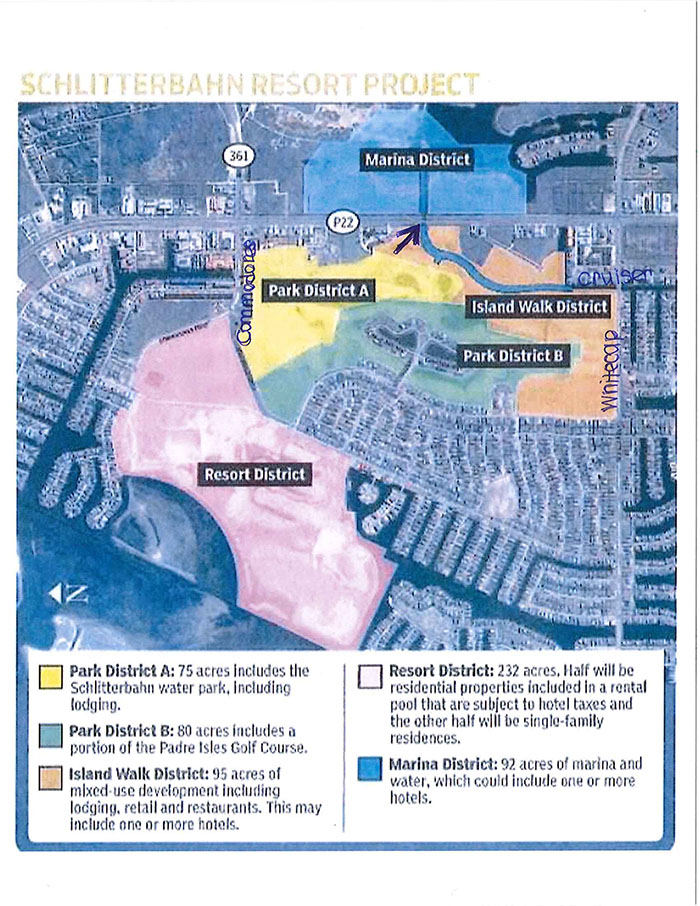

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes. I just had the pleasure of taking a safety course with our own city Sheriff Jim Kaelin, in lieu of Realtor® safety month. Although the course was geared toward real estate agents learning safety tips, it occurred to me that these tips and tricks apply to far more scenarios than just being cornered in a vacant home. So I thought I’d share some of the valuable and potentially life-saving techniques that we should all keep in our back pocket – alongside our tactical keychain.

I just had the pleasure of taking a safety course with our own city Sheriff Jim Kaelin, in lieu of Realtor® safety month. Although the course was geared toward real estate agents learning safety tips, it occurred to me that these tips and tricks apply to far more scenarios than just being cornered in a vacant home. So I thought I’d share some of the valuable and potentially life-saving techniques that we should all keep in our back pocket – alongside our tactical keychain. These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!). You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.

You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.

STOP! Or, you soon will be! On August 18th, a traffic light at the intersection of Aquarius and SPID was approved by the City Council.

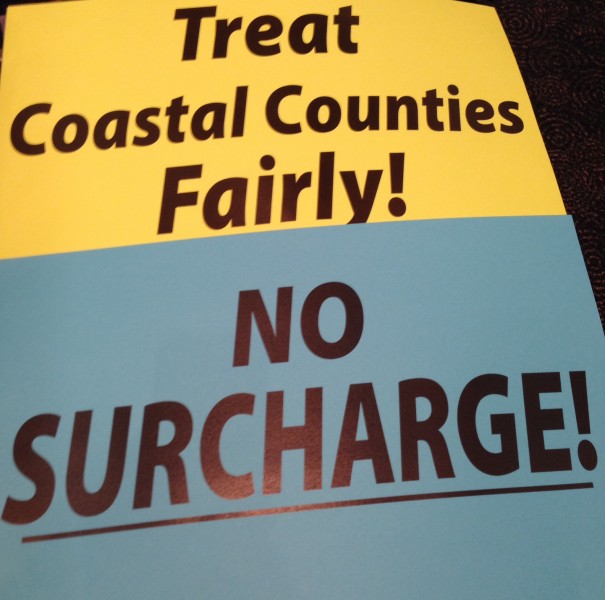

STOP! Or, you soon will be! On August 18th, a traffic light at the intersection of Aquarius and SPID was approved by the City Council. It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, and windstorm insurance. And in 2012, the Texas Department of Insurance (TDI) proceeded forward with several proposals to fund the Texas Windstorm Insurance Association (TWIA), the provider of last resort for windstorm insurance on our coast. It was then that TWIA adopted a 5% increase on all residential and commercial windstorm insurance policies to policyholders in the 14 counties (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy) comprising the Texas Coast. This was the third rate increase since 2009. But the long fight is finally over.

It’s no secret that it costs a lot to live on the coast, especially once you add up your taxes, homeowner’s insurance, flood insurance, and windstorm insurance. And in 2012, the Texas Department of Insurance (TDI) proceeded forward with several proposals to fund the Texas Windstorm Insurance Association (TWIA), the provider of last resort for windstorm insurance on our coast. It was then that TWIA adopted a 5% increase on all residential and commercial windstorm insurance policies to policyholders in the 14 counties (Aransas, Brazoria, Calhoun, Cameron, Chambers, Galveston, Jefferson, Kenedy, Kleberg, Matagorda, Nueces, Refugio, San Patricio, and Willacy) comprising the Texas Coast. This was the third rate increase since 2009. But the long fight is finally over.

On Thursday, February 13th, at the Padre Island Business Association lunch, Jeff Shea, Site Manager for M&G Chemicals, spoke to update us on the M&G Chemicals PET/PTA Facility.

On Thursday, February 13th, at the Padre Island Business Association lunch, Jeff Shea, Site Manager for M&G Chemicals, spoke to update us on the M&G Chemicals PET/PTA Facility.