The eviction moratorium has been extended through October 3, but that doesn’t mean scammers have postponed their tricks. Con artists often take advantage of the confusion and stress surrounding significant events. With more than 450,000 Texans behind on their rent, the moratorium’s end is a perfect hook.

How the Scam Works

As the eviction moratorium winds down, watch out for scammers offering loans, peddling credit repair services, or promoting government programs. These cons are a way to trick desperate people out of money they don’t have.

For example, during the COVID-19 pandemic, BBB Scam Tracker has seen numerous reports of phony “pandemic relief” grants or government programs that allegedly provide funding to people impacted by the pandemic. Once you “qualify for the grant,” the scammer will ask you to pay a processing or delivery fee to receive your funds. Of course, the grant doesn’t exist, and if you pay upfront, you just gave money to scammers.

Advance fee loans, debt relief and credit repair scams work in a similar way. They promise a loan – or to repair your credit – for an upfront fee. No matter how much you may need it, don’t be tempted by “guaranteed loans” or impossible services, such as removing late payments or bankruptcy, from your credit report.

This recent BBB Scam Tracker report describes a situation more people will likely encounter as the eviction moratorium nears. “I’d been in a desperate financial situation for a few weeks now, so I had been looking for loans and being denied left and right,” the scam victim told BBB. The victim received a call from a loan provider, saying their loan application had finally been accepted. There was just one catch: before the company could release the money, the borrow had to increase their credit score. Fortunately, this company had a way to help. “The way they would do that is they would send money to my account and then all I would have to do is send it back and that would boost my score.” Of course, the scammers never actually transferred the money. When the victim “sent back” the funds, they transferred $1,000 into the hands of scammers and caused their account to overdraft.

Protect yourself from this scam:

Double-check any government program before you sign up. If an organization is offering you a grant or relief funds, get to know them before agreeing to anything. Take a close look at their website and read reviews. If you think you might be dealing with an impostor, find the official contact information and call the company to verify the offer is legitimate.

Be wary of out-of-the-blue calls, emails or text messages claiming to be from the government. In general, the government will not contact you using these methods unless you have granted permission.

Think something seems suspicious? Reach out to the agency directly. If you doubt that a government representative is legitimate, hang up the phone or stop emailing. Then, report the suspicious calls or messages. Make sure the agency is real. Scammers often make up names of agencies or grants.

Do not pay any money for a “free” government grant or program. It is not free if there is a fee involved. A real government agency will not ask for an advanced processing fee. Instead, find out if the grant is legitimate by checking Grants.gov.

Advance fees are a concern. Not all businesses promising to help you repair bad credit are scams, but if you are asked to pay in advance, that’s a big red flag. In both the U.S. and Canada, credit repair and debt relief companies can only collect their fee after performing the promised services.

Avoid guarantees and unusual payment methods. Genuine lenders never guarantee a loan in advance. They will check your credit score and other documents before providing an interest rate or loan amount and will not ask you to pay an upfront fee. Fees are never paid via gift cards, CashApp, or prepaid debit cards. Unusual payment methods and payments to an individual are a big tip-off.

Get further insight by reading BBB’s tips on loans and credit repair services on BBB.org and learn more about government impostor scams during COVID-19.

If you’ve spotted a scam (whether or not you’ve lost money), report it to BBB.org/ScamTracker. Your report can help others avoid falling victim to scams.

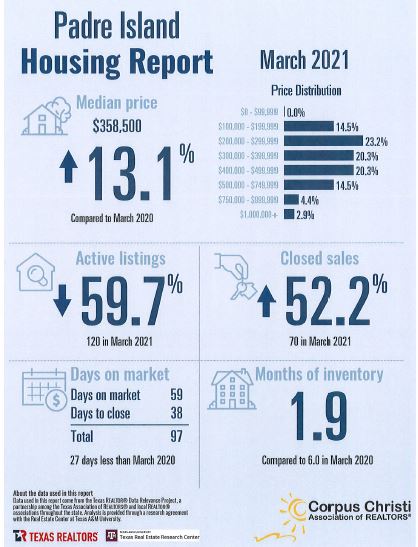

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie!

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie! They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.