March is National Nutrition Month which is an annual campaign created by the Academy

of Nutrition and Dietetics. I would like to discuss the importance of making informed food

choices by developing sound eating habits and through physical activity. Texas has been helpful

in promoting good nutrition for our citizens.

Since Texas has a diverse geography, this means that bountiful amounts of naturally

grown foods that are delicious and wholesome can be found throughout our state. Our farmers

grow nutritious vegetables and fruits in our well-kept Texas soils which allows for these foods to

have healthy amounts of essential vitamins, minerals, and antioxidants that our bodies need to

function properly. Specific foods rich in these nutrients are broccoli, blueberries, spinach,

cauliflower, tomatoes, peaches, squash, onions, tree nuts (pecans, almonds, etc.), oranges,

pumpkin, sweet potatoes, and many more. To learn more about Texan-grown products visit:

http://gotexan.org/Home.aspx.

However, there is not a one-size- fits all approach to nutrition and health but there are

some major ingredients and processed foods to avoid. The most prominent food to steer clear is

added sugar. Foods with added sugar are often highly caloric and have harmful effects on our

organs. Additionally, foods with high fructose corn syrup and other artificial sweeteners have

been linked to severe health problems like obesity, cardiovascular (heart) disease and type two

diabetes. However, these sweeteners can be replaced with products such as raw honey or stevia

which are better alternatives to use in baking or iced/hot tea and coffee.

Another food group to be cautious with is artificial trans fats, also known as partially

hydrogenated oils. Trans fats have been linked with raising bad cholesterol and lowering good

cholesterol. This can lead to health risks such as high blood pressure which can cause poor blood

circulation in our bodies. The regular consumption of trans fats have also been shown to lead to

diabetes, Alzheimer’s disease, and obesity.

Taking advantage of all the wonderful whole foods our state has to offer is beneficial in

many ways because making smarter nutritional choices can go a long way. To learn more about

nutrition visit: https://www.nutrition.gov/. In addition to this, you can visit the Texas Department

of Agriculture's website at https://www.texasagriculture.gov/Home.aspx. For more information

about National Nutrition Month and the Academy of Nutrition and Dietetics, please visit:

https://www.eatright.org/food/resources/national-nutrition-month.

If you have questions regarding any of the information mentioned in this week’s article,

please do not hesitate to call my Capitol or District Office. Please always feel free to contact my

office if you have any questions or issues regarding a Texas state agency, or if you would like to

contact my office regarding constituent services. As always, my offices are available at any time

to assist with questions, concerns, or comments (Capitol Office, 512-463-0672; District Office,

361-949-4603).

– State Representative Todd Hunter, District 32

Rep. Hunter represents Aransas County and Nueces (Part) County. He can be contacted at

todd.hunter@house.state.tx.us or at 512-463-0672.

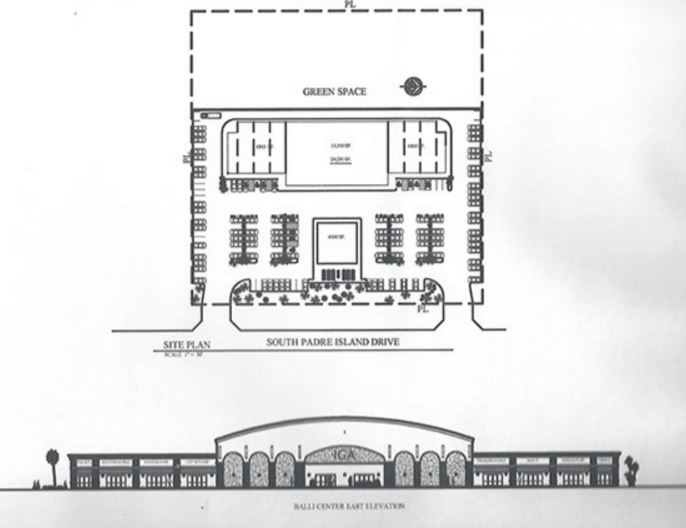

As we enter 2026, the island and the greater Corpus Christi area are gearing up for another successful tourism season, with several city efforts focused on enhancing the visitor experience while supporting local businesses and residents alike. With Spring Break and summer on the horizon, the City proactively launches beach maintenance, park improvements, and business-friendly policies aimed at keeping our coastal community welcoming and safe.

As we enter 2026, the island and the greater Corpus Christi area are gearing up for another successful tourism season, with several city efforts focused on enhancing the visitor experience while supporting local businesses and residents alike. With Spring Break and summer on the horizon, the City proactively launches beach maintenance, park improvements, and business-friendly policies aimed at keeping our coastal community welcoming and safe.

More shut-eye

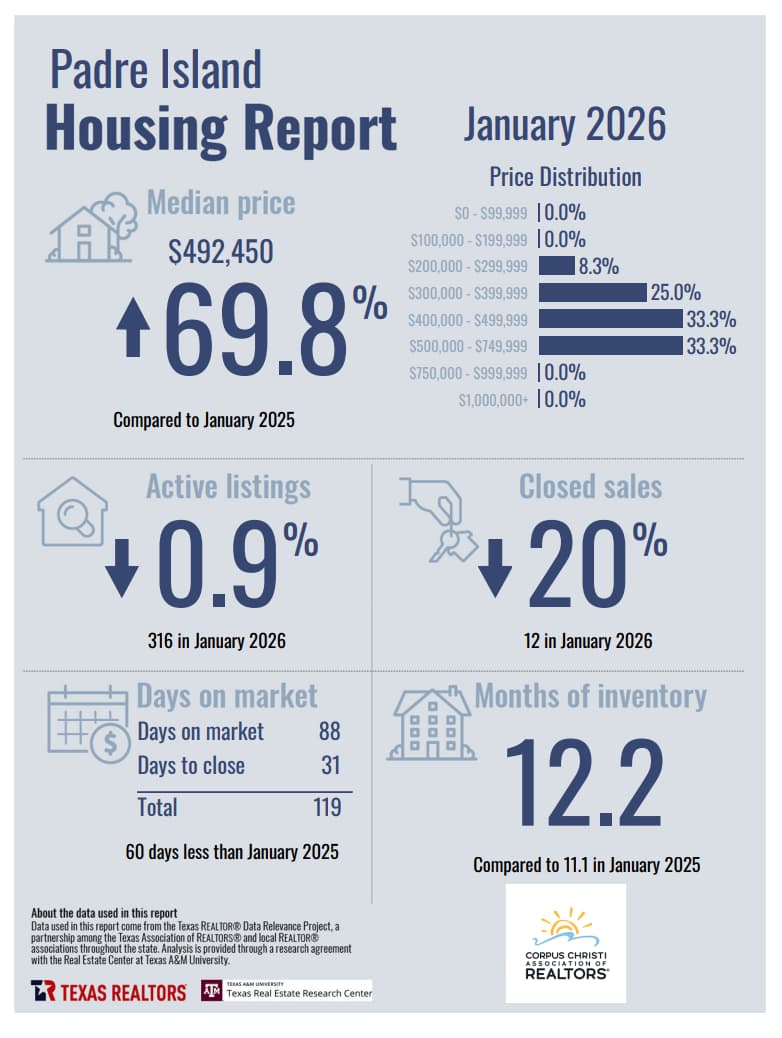

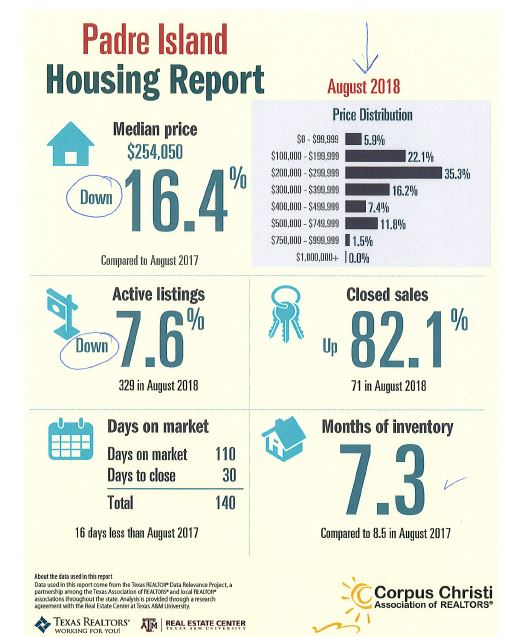

More shut-eye Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Corpus Christi’s newly appointed water director knows a few things about fixing water system woes.

Corpus Christi’s newly appointed water director knows a few things about fixing water system woes.