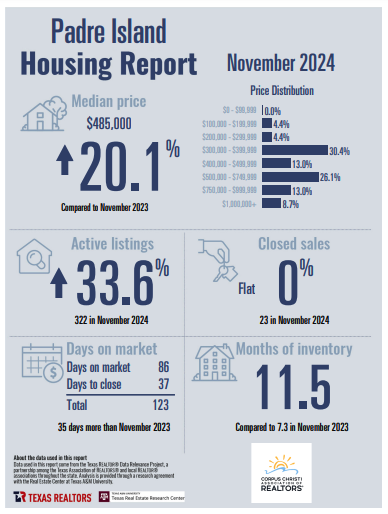

Corpus Christi Association of Realtors has posted the Padre Island Corpus Christi Housing Report for November 2024.

Our active listing median prices have softened the past month to $485,000 which is actually a 20.1% increase from where it was compared to last November at this time! CCAR shows us the data that has risen for active listings t0 33.6% with a total of 322 properties this past month compared to November 2023 while inventory also rose to 11.5 compared to 7.3 last year at this time.

Days on the market stayed steady this past month with an average of 86 days and the highest categories for sales with 30.4% of all the sales being priced between $300,000 – $399,999. The market is still softening a bit as we head into the last month of 2024 with properties available across many pricing areas. Padre Island’s newest development Whitecap NPI is open for sales of their lots in Phase 1, Contact Coastline Properties Agent Ms. Amber Spicak at their office for all pre-sales. amber@coastline-properties.com

The Consumer Price Index for All Urban Consumers (CPI-U) rose by 0.3 percent on a seasonally adjusted basis in November versus the prior month, following four consecutive months of 0.2 percent increases. Over the past 12 months, the all-items index has increased by 2.7 percent before seasonal adjustment.

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island Corpus Christi real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!