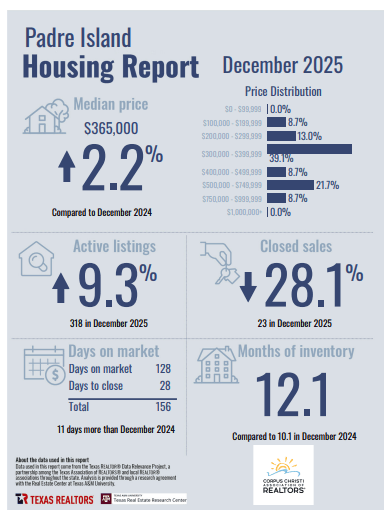

Corpus Christi Association of Realtors has posted the Padre Island Corpus Christi Housing Report for December 2025.

December closed the year with a clear message for Padre Island. The market slowed, but it did not slide. Prices held. Inventory grew. Buyers paused. Sellers adjusted.

At the start of the month, the median home price landed at $365,000. That number sits 2.2 percent higher than December 2024. This matters. Even with fewer sales and more listings, prices stayed resilient. The island did not give back ground.

Most activity clustered in the middle of the market. Homes priced between $300,000 and $399,999 made up 39.1 percent of all sales. This range remains the heartbeat of the island. The next strongest segment came from homes priced between $500,000 and $749,999 at 21.7 percent. Entry level inventory stayed thin, with very little movement below $200,000.

Inventory told a different story. Active listings rose 9.3 percent year over year, ending December with 318 homes on the market. Buyers saw more options than they have in several years. Sellers faced more competition, especially in higher price ranges.

Sales activity slowed sharply. Only 23 homes closed during the month, a 28.1 percent drop compared to last December. Higher borrowing costs and cautious buyers stretched decision timelines. Fewer deals closed, but serious buyers stayed engaged.

Time on market continued to lengthen. Homes averaged 128 days before going under contract, followed by another 28 days to close. From list to finish, the process now averages 156 days. That is 11 days longer than last year. Speed favors sellers who price correctly and prepare well. Everyone else waits.

The clearest signal came from months of inventory. Padre Island ended December at 12.1 months. Last year closed at 10.1 months. This shift confirms a buyer favored environment. Choice returned. Negotiation returned. Balance moved.

This market did not collapse. It reset. Prices remained firm because people still want to live here. Sales slowed because buyers became selective. Inventory grew because sellers stayed confident.

Padre Island closed 2025 steady, not rushed and not overheated. Buyers gained breathing room. Sellers gained clarity. The island kept its long term appeal, driven by lifestyle, location, and limited land.

Padre Island’s newest development Whitecap NPI is open for sales of their lots in Phase 1, Contact Coastline Properties owner Cheri Sperling for all pre-sales. sperling@coastline-properties.com

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island Corpus Christi real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!

They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

They fly, crawl, bite, invade and annoy! And the word is that this summer, they’re coming in larger numbers due to the increased rain we’ve received this spring.

Corpus Christi’s newly appointed water director knows a few things about fixing water system woes.

Corpus Christi’s newly appointed water director knows a few things about fixing water system woes.