If you are looking to Purchase or List a home on Padre Island…Ask for the ONLY Padre Island EXPERTS!

The current construction boom is affecting sales of “used” homes. Since the end of the last housing boom in 2006, Corpus Christi has followed closely the statewide market. The number of new home permits reflects residential construction activity. The properties being watched closely are priced below $300,000.

Unlike the market for single-family homes, rental housing faced record high vacancy rates. Following Hurricane Harvey, residents displaced by damage have turned to apartments around Corpus Christi rather than properties on Padre Island.

Despite a recent slowdown in new home construction due in part to rising material costs and skilled-labor shortages, new construction is still selling strong. If the home looks good, priced right and marketed professionally – it’ll sell. With all the industry being developed in and around the Corpus Christi Ship Channel, Corpus Christi is going to benefit and home owners will benefit. The ongoing industrial construction activity is adding construction employment and permanent manufacturing jobs. Replacement of the Harbor Bridge by 2020 will add another 600 construction jobs during its peak time. Hang on Corpus Christi – times are going to be changing!

Our Coastline team lists and sells throughout the Texas Coastal Bend – but we Specialize and are considered the area Experts on Padre Island. When you think about Real Estate on Padre Island, everyone thinks about Coastline Properties. Come Coast Awhile….with us!!

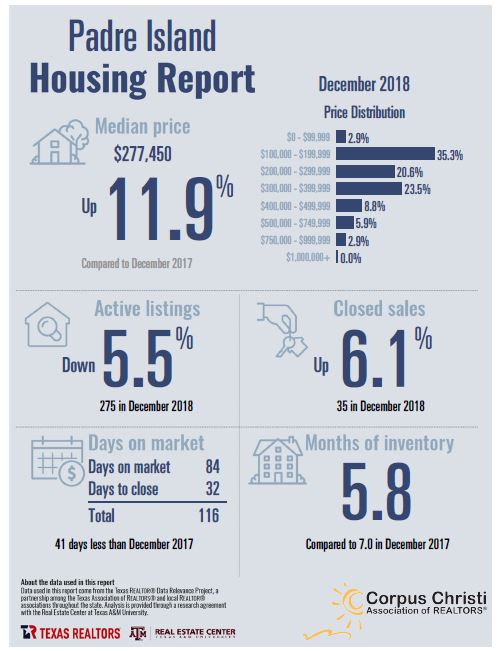

Padre Island December 2018 Data (Click Pic below for PDF)

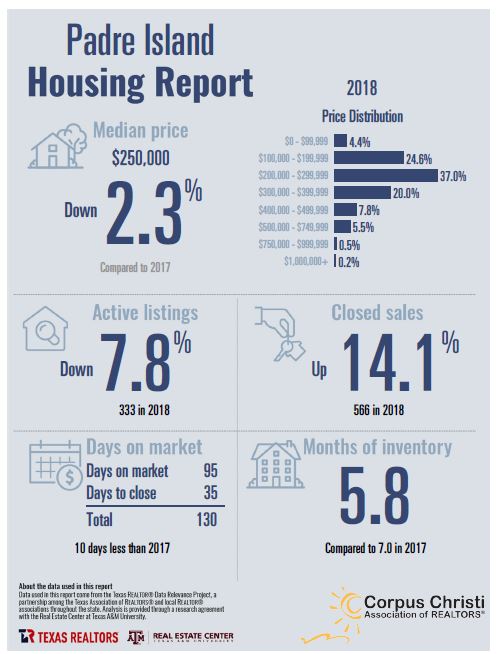

Padre Island Annual Housing Data 2018 (Click Pic Below for PDF)

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for