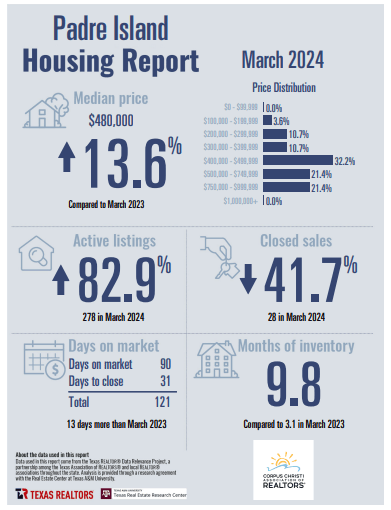

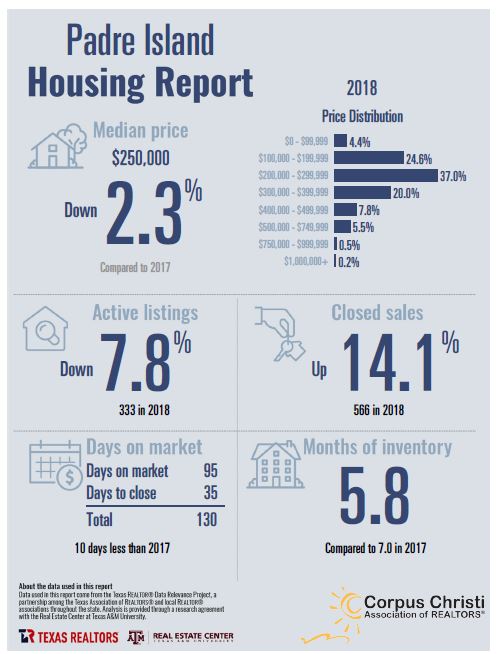

Corpus Christi Association of Realtors has posted the North Padre Island Housing Report for March 2024.

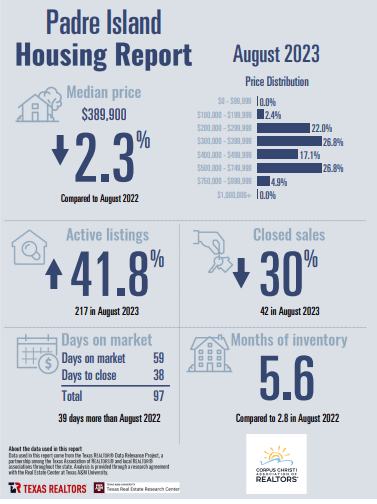

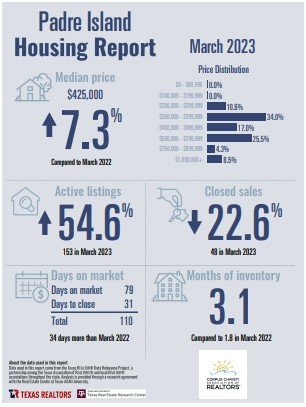

Our active listing median prices have risen the past month to $480,000 this past month which is an 13.6% decrease from where it was compared to last March at this time! CCAR shows us the data that is increasing for active listings by 82.9% with a total of 278 properties this past month while inventory Has risen at 9.8 compared to 3.1 last year at this time.

Days on the market for sale increased this past month with an average of 90 days and the highest categories for sales with 32.2% of all the sales being priced between $400,000 – $399,999. The market is still staying very stable so far into 2024 with properties available across many pricing areas. North Padre Island’s newest development Whitecap NPI is open for sales of their lots in Phase 1, Contact Coastline Properties Agent Ms. Amber Spicak at their office for all pre-sales. amber@coastline-properties.com

The consumer price index climbed 3.5% year over year in March, according to data released today by the Bureau of Labor Statistics, faster than February’s 3.2% pace. Economists surveyed by FactSet had expected an annual increase of 3.4%.

Cheri Sperling is the owner of Coastline Properties with a dedicated team of agents specializing in residential listings, sales, and property management in the Padre Island real estate market. Coastline’s team is the most knowledgeable real estate office on Padre Island. No pressure style, patience, and an intimate understanding of the local market. They go to work for you!

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for