Have you ever come home to find that your house has been broken into, your husband has canceled your recordings of The Bachelor, and it appears as though your “big bad guard dog” has actually led the robber to the fine china? I truly have “seen red” before. And I bet you have, too.

So how do colors affect human emotion and reaction? Company owners, home decorators, web designers, have all recently been paying more attention to not only what colors to choose, but why to choose them. Color psychology is now known to play a larger role in marketing, design and branding. Perhaps as homeowners, we, too, should choose wisely. The colors you choose for your spaces can actually play a role in your mood and temperament.

Black begs power and authority. You wouldn’t bully the karateka sporting the black belt.

For the home: Choose an accent wall in your home office and paint it black! Own your work space, and make it be known that you’re the boss in there! It will demand dominance.

White symbolizes purity, innocence, and sterility. Wouldn’t it just seem odd to baptize a baby in a red gown? Or to paint the walls of an operating room a dirty tone of split pea soup?

For the home: If you have a case of kitchen OCD, a white kitchen is a necessity. White will make the kitchen appear larger (and it IS the heart of the house, so the bigger, the better!), but the more sterile this room feels, the better. Perhaps your guests don’t want to question whether their food was prepared in a germ breeding ground, as white countertops and cabinets are no hiding place for grease splatters or red wine rings.

Red brings about feelings of passion and rage. Studies also show that it increases circulation, action, and exudes an empowering masculine energy.

For the home: Assuming most households do have at least one man in them, perhaps use red as an accent color: Red pillows, a red door, red vases. Does your house have a man cave? Red that room!

Orange has the tendency to elicit increase in energy and optimism. Think of the fruit – it’s bright, sweet, makes you want to do an Irish jig.

For the home: If you have a home gym, this is the PERFECT place for this color. It will likely give you that needed boost an extra shot of espresso may provide…without the calories!

Yellow sometimes enhances concentration, but can lead to irritability and anxiety. Just because it’s gender neutral doesn’t mean you should paint your nursery this color. Studies have shown that the same baby will cry more in a yellow room than in a blue room.

For the home: As with red, use this color as an accent. If you just love the color, a downstairs powder room would be a nice place to put yellow on the walls. It will add a kiss of zest to the first floor. Consider the sun…it’s always nice when it’s out, but you never want to stare at it!

Green…ahhhh green. It’s natural…relaxing…can’t you smell the fresh cut grass? Not only does green bring you down to earth, but it can symbolize greed and envy. So, use green wisely.

For the home: Incorporate green by using indoor plants! Plants will bring the outdoors in, and studies have shown plants and flowers will reduce stress and improve general well-being. You wouldn’t bring your sick friend a gerbil, right? You’d bring them a fresh bouquet! If you’d rather bring green in another way, go with a nice pale green for the living room.

Blue has a similar effect as green. You feel calm around blue. It symbolizes loyalty and peace. Straight from Wikipedia, “In 2000, Glasgow installed blue street lighting in certain neighborhoods and subsequently reported the anecdotal finding of reduced crime in these areas.”

For the home: I’d choose a navy blue as an accent wall in the dining room, or a light blue for a bedroom. If you’re like most, your bedroom is the one place you can really go to unwind. Blue will allow you to feel soothed and restful. Light up a beach wood candle, and you’re in heaven! Just don’t go painting clouds on the ceiling. Then you’ve taken it too far.

Purple is the color of royalty, wealth, and sometimes romance. In ancient healing therapies, the color psychology behind purple was believed to treat skin problems, and purple crystals were used for both emotional and physical healing.

For the home: If it is believed to aid in skin therapy, what better place for a purple paint job than the master bathroom? Maybe the good purple vibes will work their magic and make you forever beauteous. If that’s not what you’re about, picture a relaxing lavender scented bath. Purple is also said to spark the imagination. I know many people do their best thinking in the bathroom!

Pink makes people think of love and romance. But it also brings about a sense of nurturing and immaturity – the silly, playful kind.

For the home: A little girl’s bedroom is the obvious choice here. But I think another less obvious space would be lighter maroon color in a playroom. This may help mold creative thoughts and visionary children.

Now go grab some color swatches, and create your own desired household aura!

TWIA NEWS…….

TWIA NEWS…….

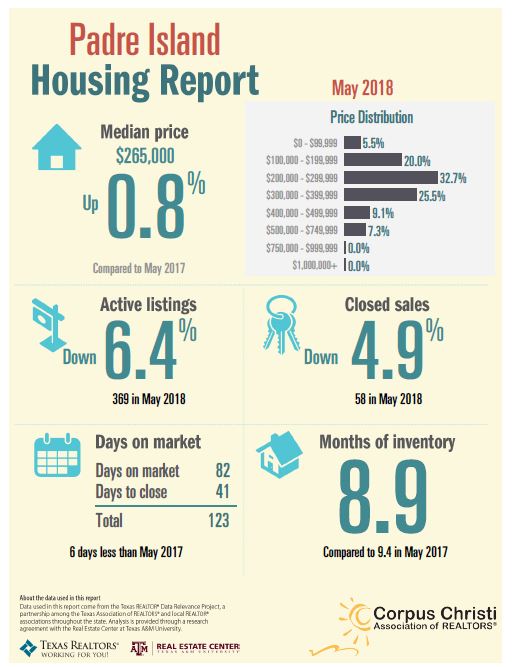

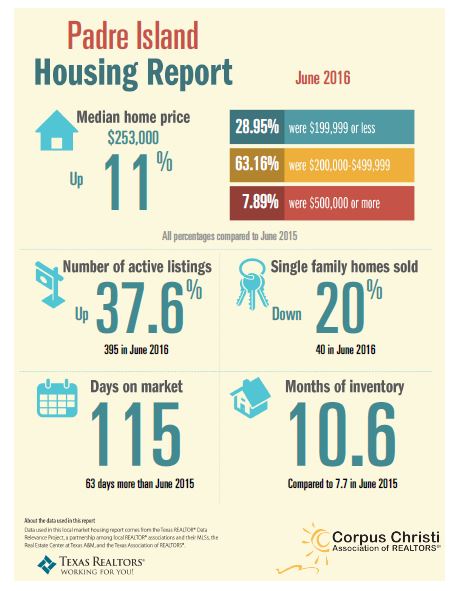

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

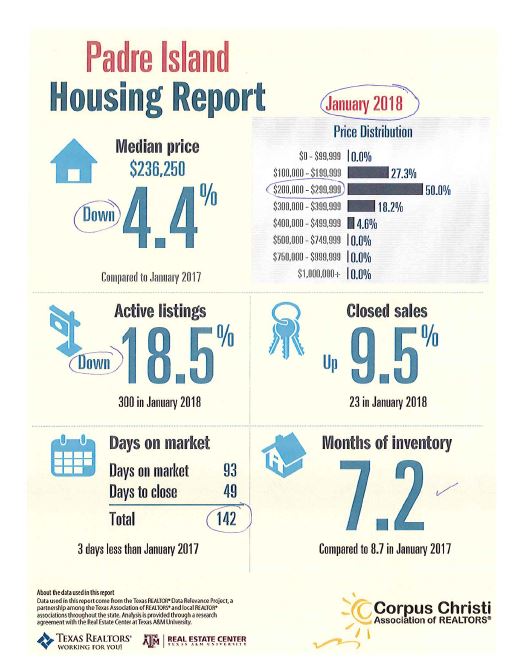

Here is our top 6 tips for the New Year

Here is our top 6 tips for the New Year

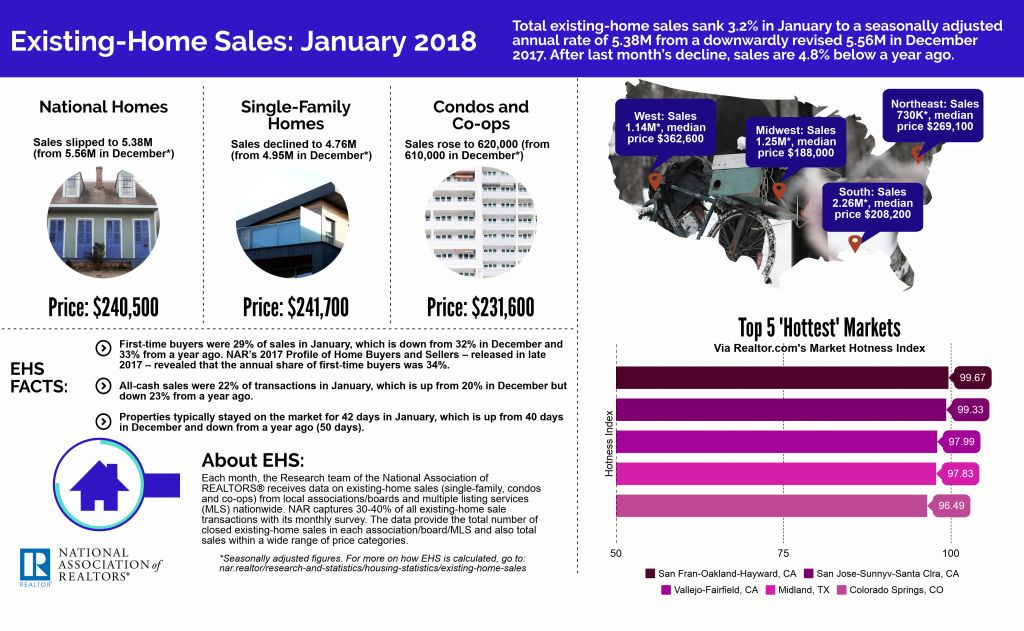

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.

You got your home under contract! You’re so excited, a buyer loves your home as much as you do! Then, inspections are set up. The three inspections typically performed on a home here are the general inspection, the pest inspection, and the plumbing inspection.