March is National Nutrition Month which is an annual campaign created by the Academy

of Nutrition and Dietetics. I would like to discuss the importance of making informed food

choices by developing sound eating habits and through physical activity. Texas has been helpful

in promoting good nutrition for our citizens.

Since Texas has a diverse geography, this means that bountiful amounts of naturally

grown foods that are delicious and wholesome can be found throughout our state. Our farmers

grow nutritious vegetables and fruits in our well-kept Texas soils which allows for these foods to

have healthy amounts of essential vitamins, minerals, and antioxidants that our bodies need to

function properly. Specific foods rich in these nutrients are broccoli, blueberries, spinach,

cauliflower, tomatoes, peaches, squash, onions, tree nuts (pecans, almonds, etc.), oranges,

pumpkin, sweet potatoes, and many more. To learn more about Texan-grown products visit:

http://gotexan.org/Home.aspx.

However, there is not a one-size- fits all approach to nutrition and health but there are

some major ingredients and processed foods to avoid. The most prominent food to steer clear is

added sugar. Foods with added sugar are often highly caloric and have harmful effects on our

organs. Additionally, foods with high fructose corn syrup and other artificial sweeteners have

been linked to severe health problems like obesity, cardiovascular (heart) disease and type two

diabetes. However, these sweeteners can be replaced with products such as raw honey or stevia

which are better alternatives to use in baking or iced/hot tea and coffee.

Another food group to be cautious with is artificial trans fats, also known as partially

hydrogenated oils. Trans fats have been linked with raising bad cholesterol and lowering good

cholesterol. This can lead to health risks such as high blood pressure which can cause poor blood

circulation in our bodies. The regular consumption of trans fats have also been shown to lead to

diabetes, Alzheimer’s disease, and obesity.

Taking advantage of all the wonderful whole foods our state has to offer is beneficial in

many ways because making smarter nutritional choices can go a long way. To learn more about

nutrition visit: https://www.nutrition.gov/. In addition to this, you can visit the Texas Department

of Agriculture's website at https://www.texasagriculture.gov/Home.aspx. For more information

about National Nutrition Month and the Academy of Nutrition and Dietetics, please visit:

https://www.eatright.org/food/resources/national-nutrition-month.

If you have questions regarding any of the information mentioned in this week’s article,

please do not hesitate to call my Capitol or District Office. Please always feel free to contact my

office if you have any questions or issues regarding a Texas state agency, or if you would like to

contact my office regarding constituent services. As always, my offices are available at any time

to assist with questions, concerns, or comments (Capitol Office, 512-463-0672; District Office,

361-949-4603).

– State Representative Todd Hunter, District 32

Rep. Hunter represents Aransas County and Nueces (Part) County. He can be contacted at

todd.hunter@house.state.tx.us or at 512-463-0672.

Did you know?

Did you know?

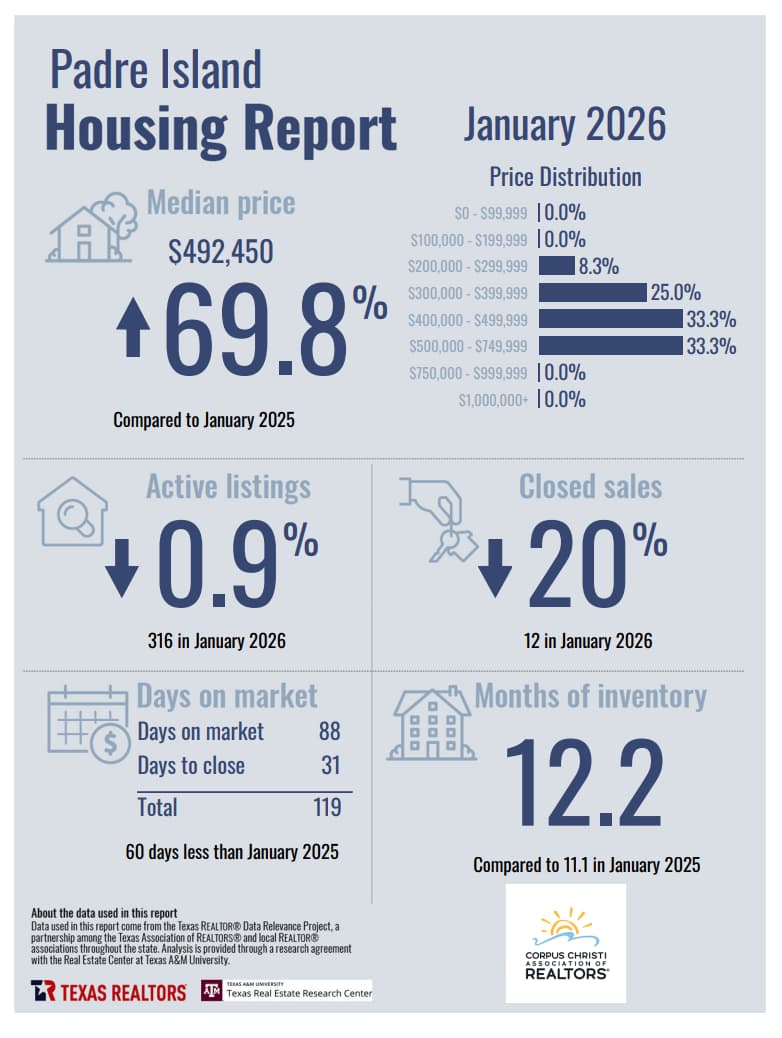

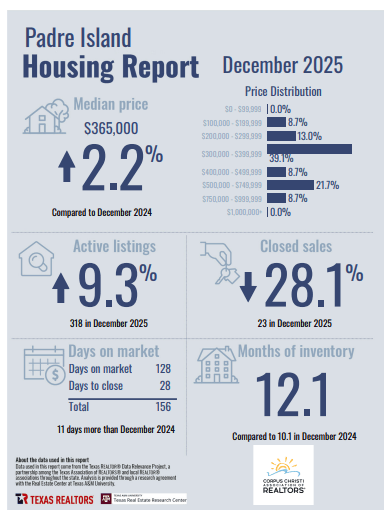

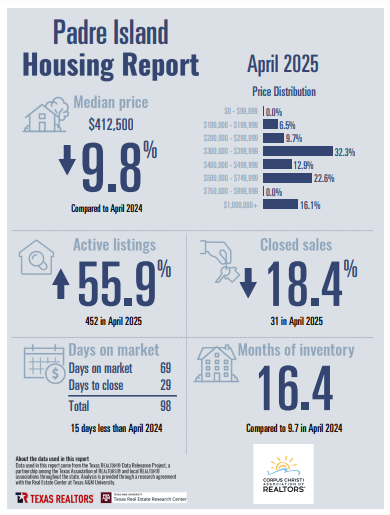

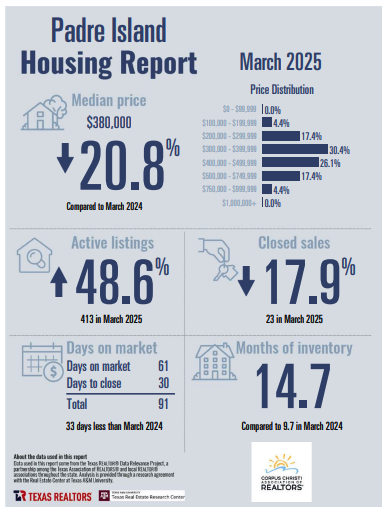

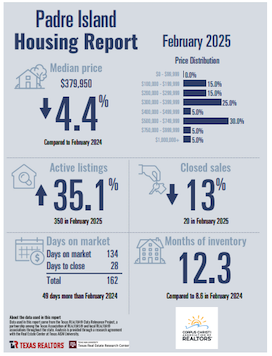

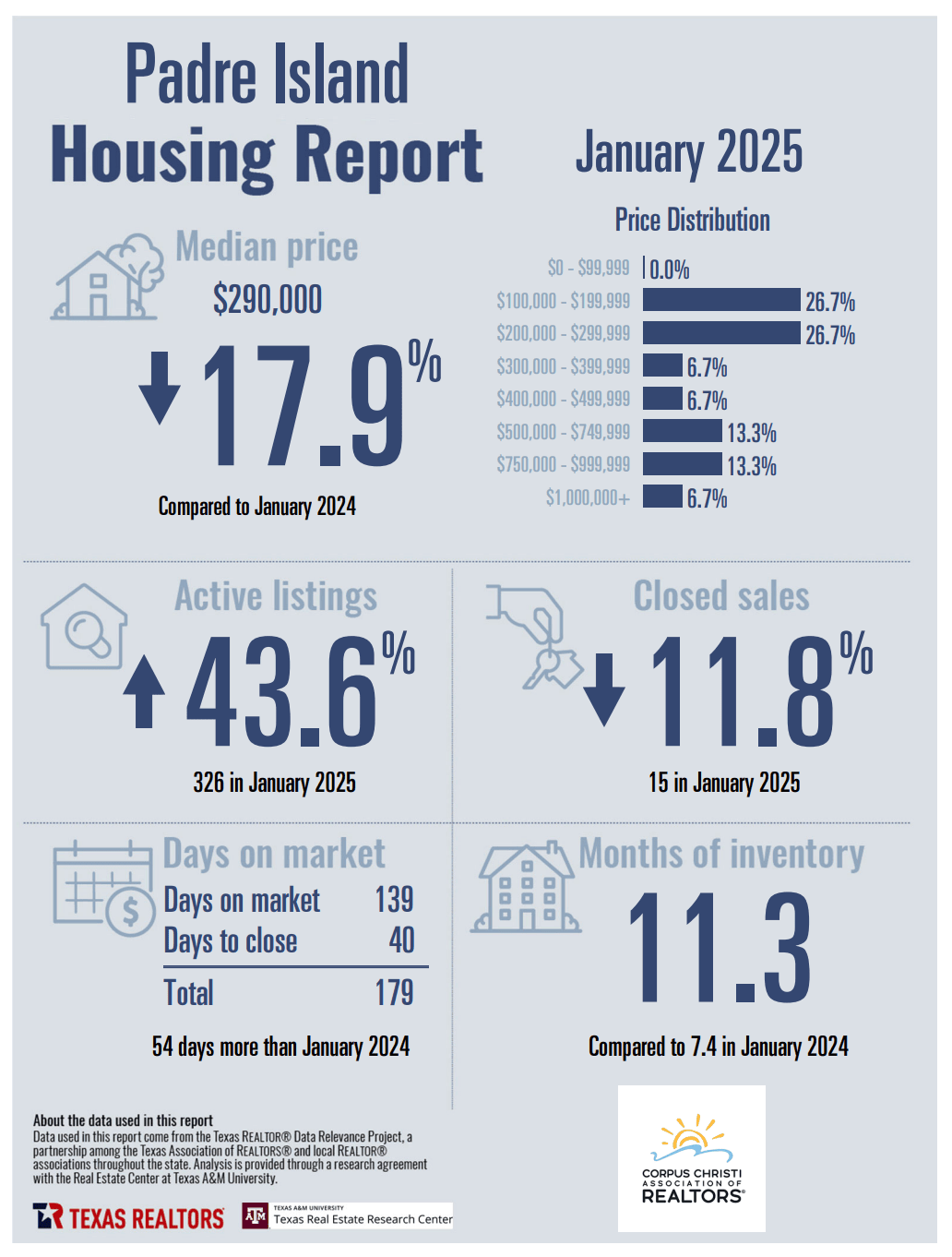

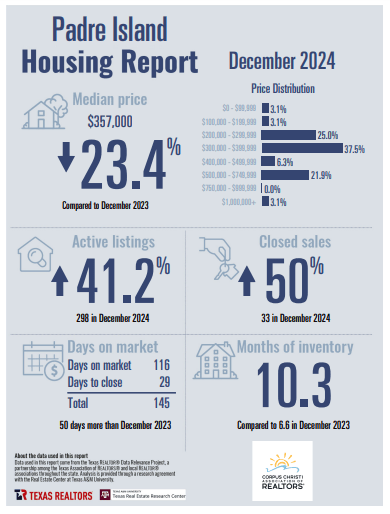

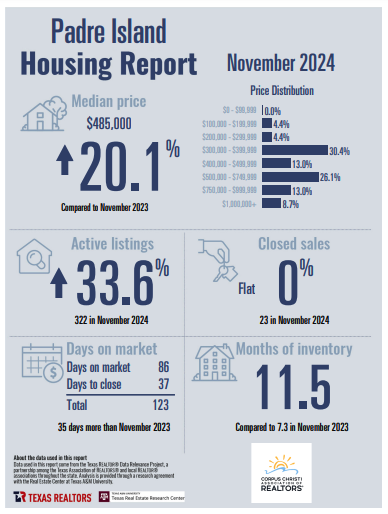

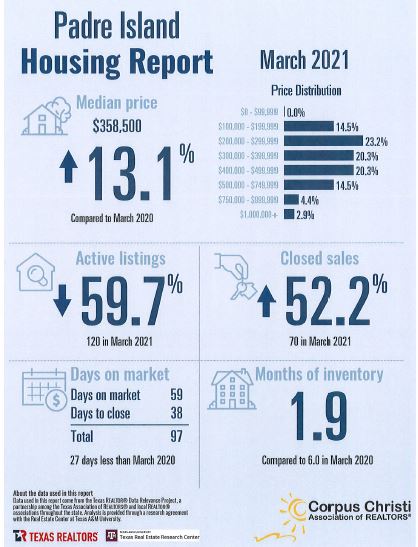

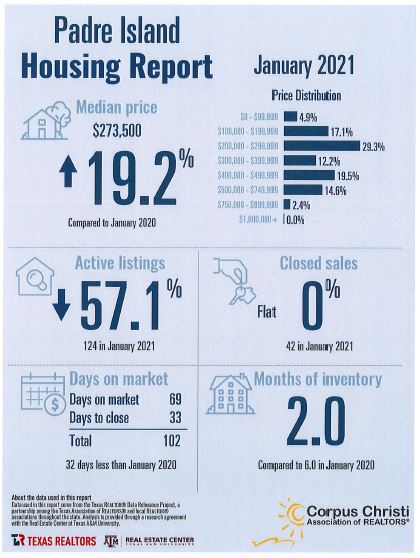

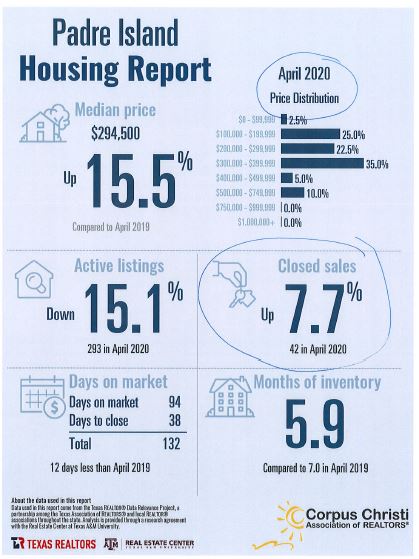

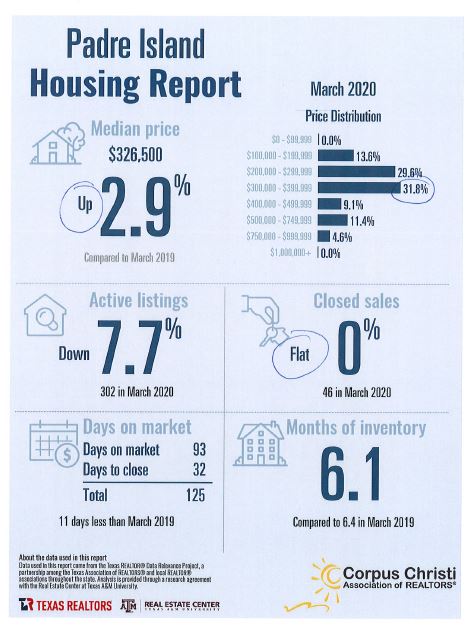

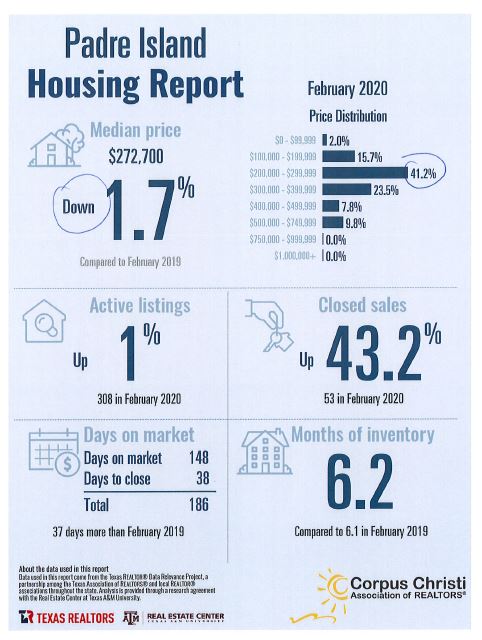

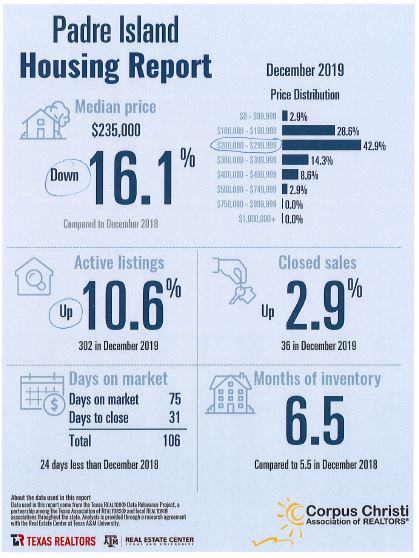

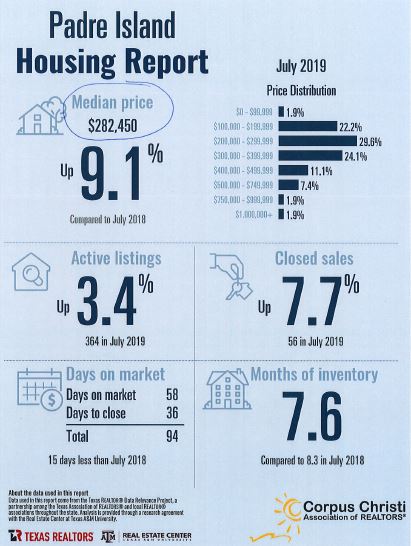

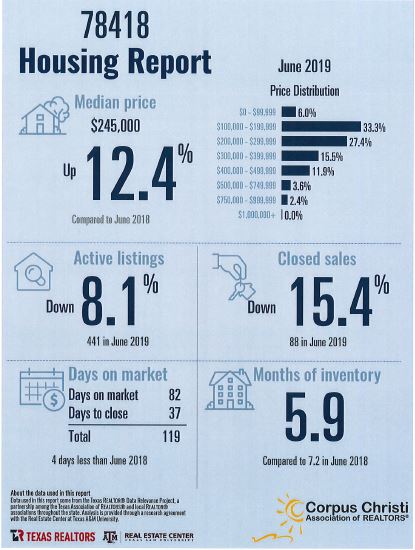

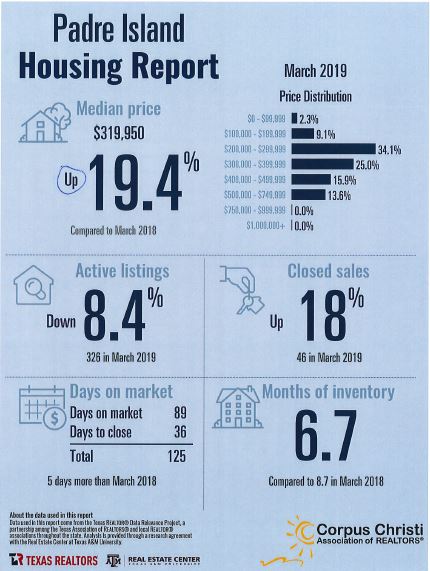

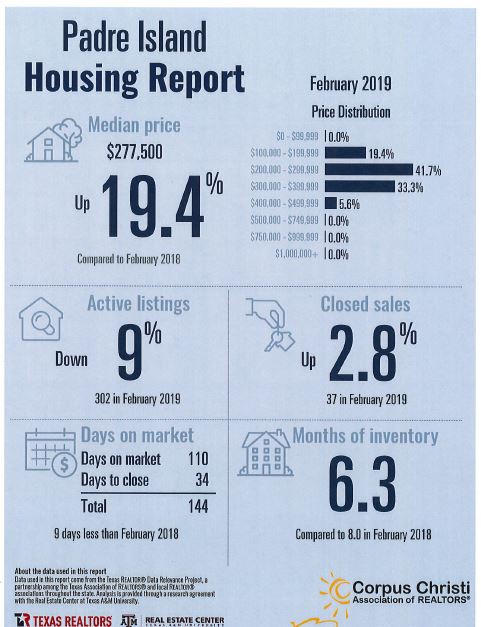

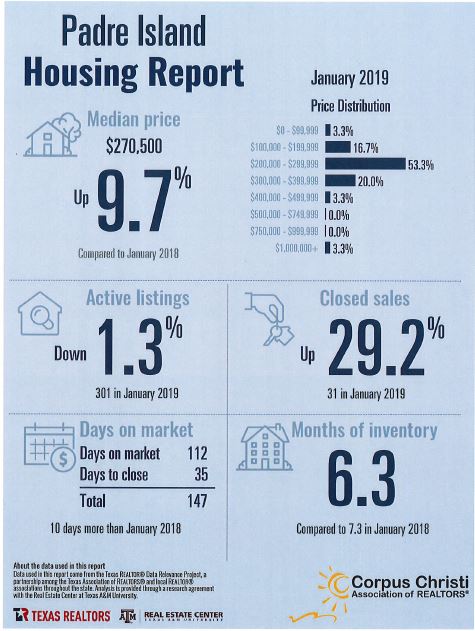

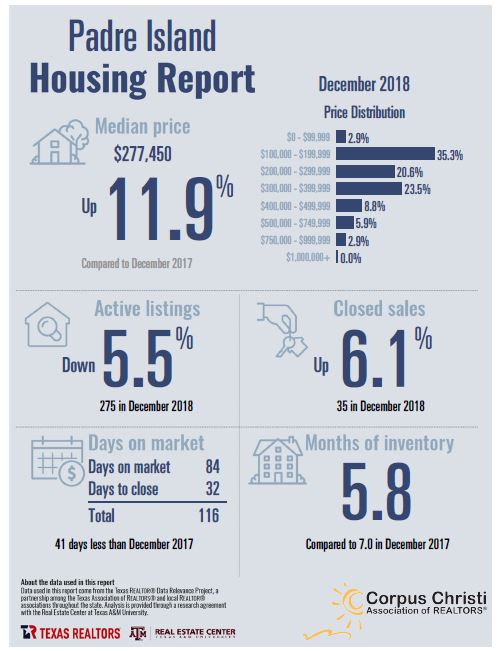

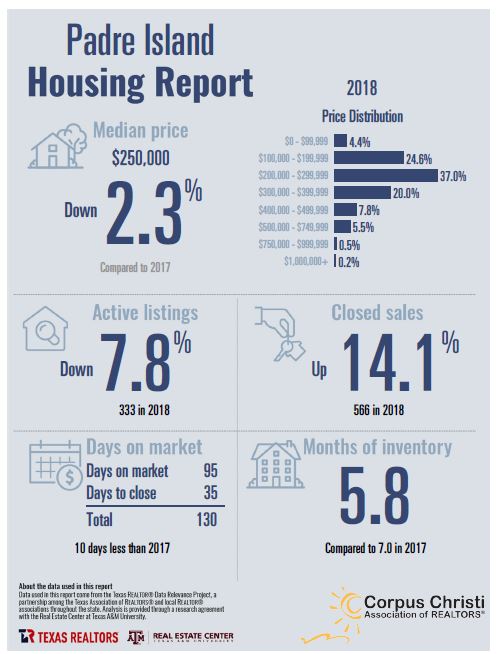

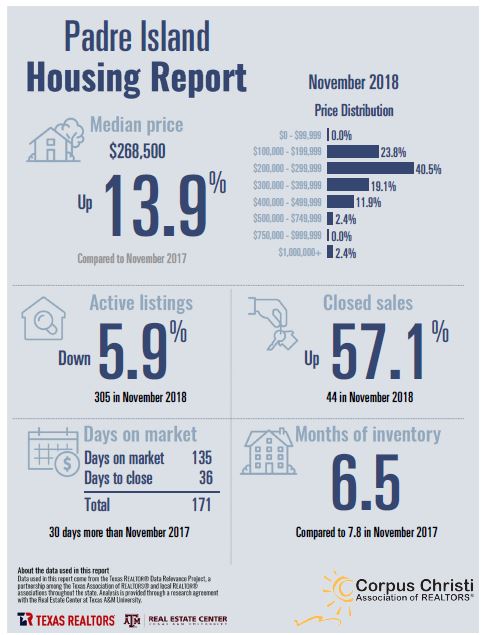

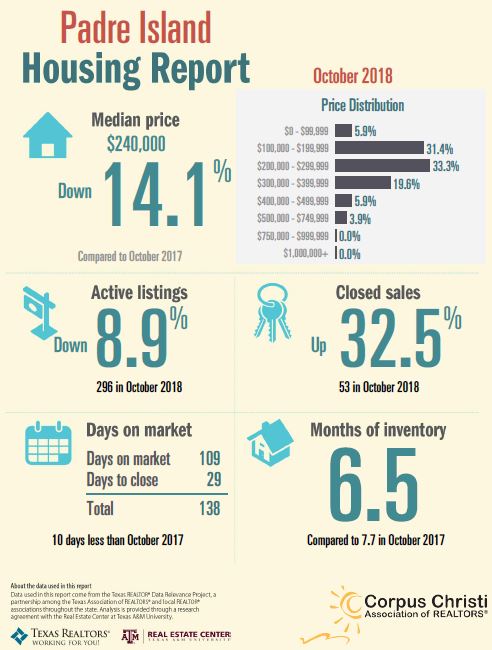

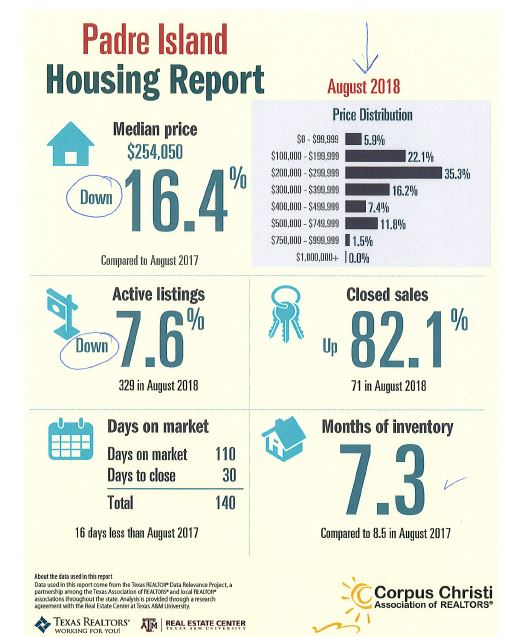

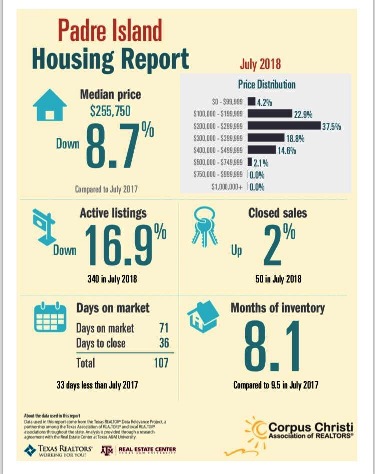

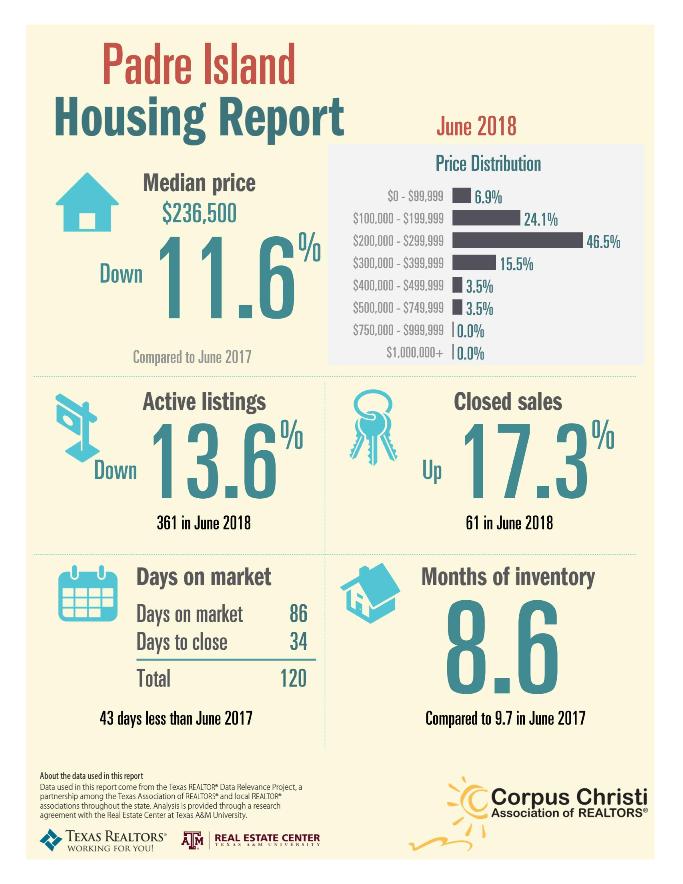

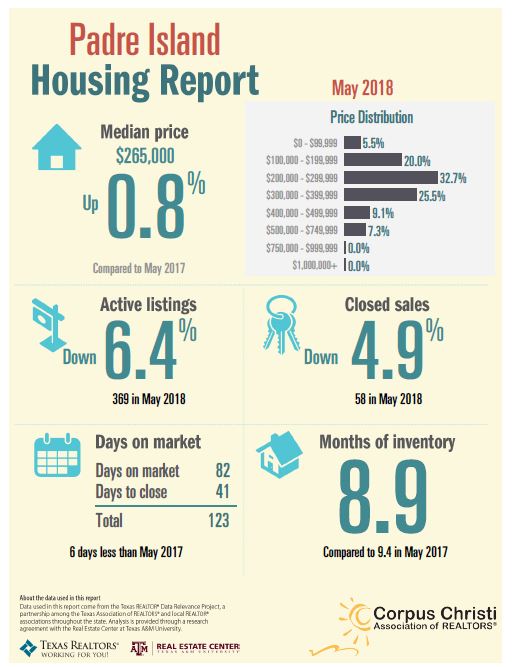

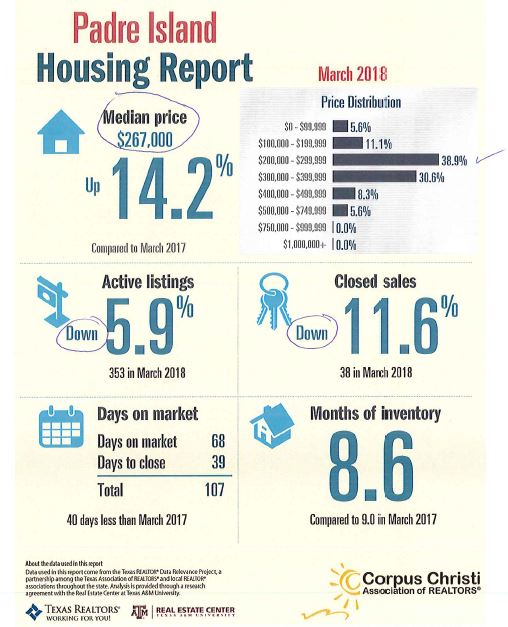

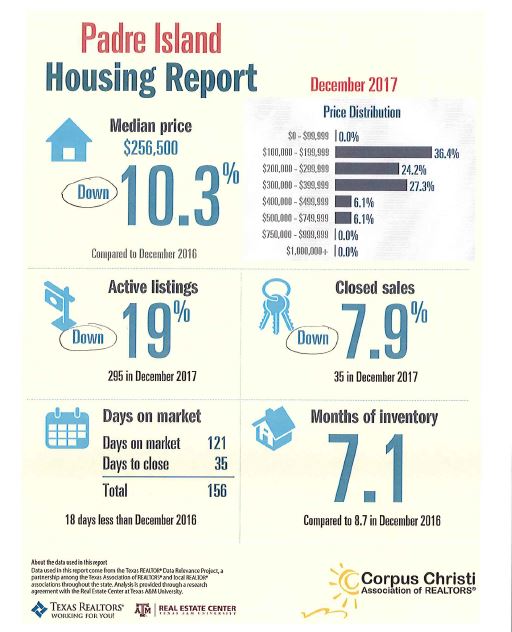

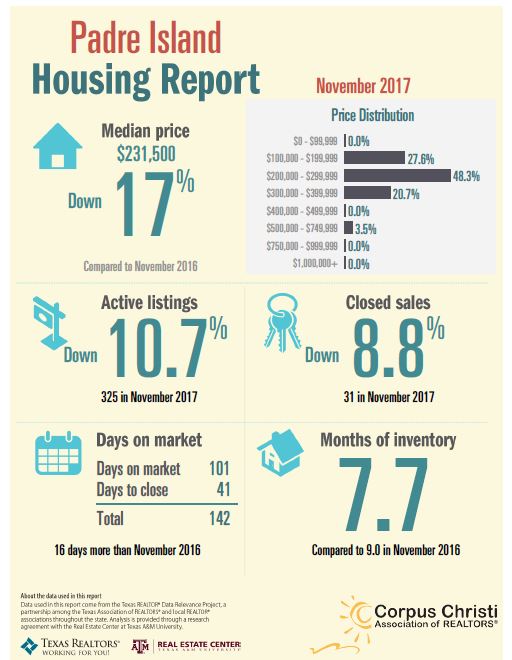

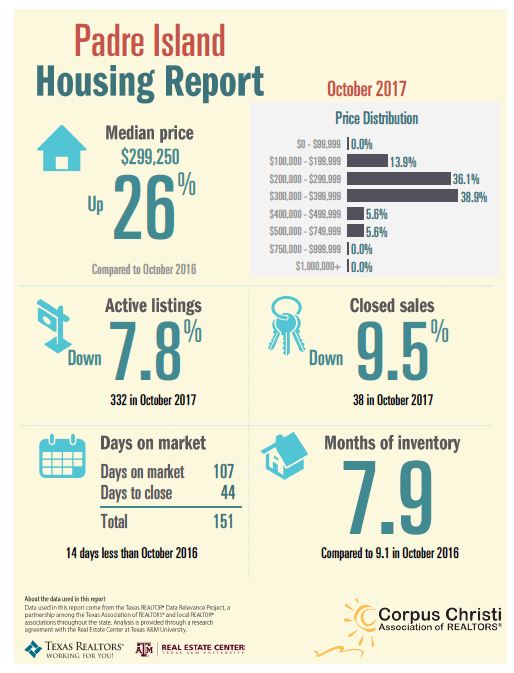

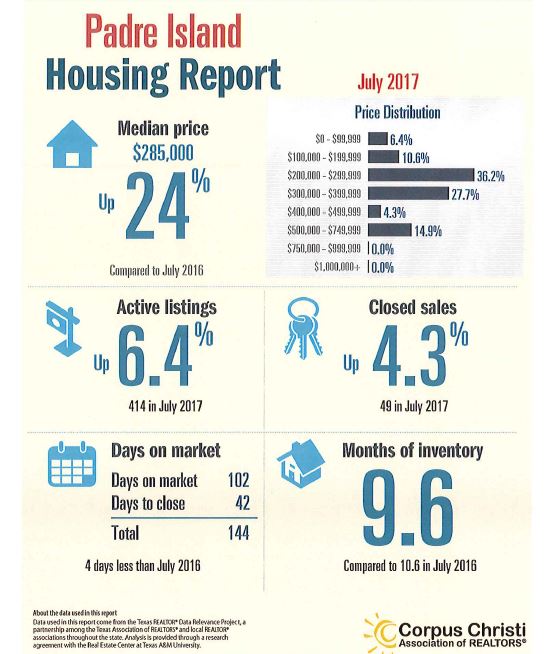

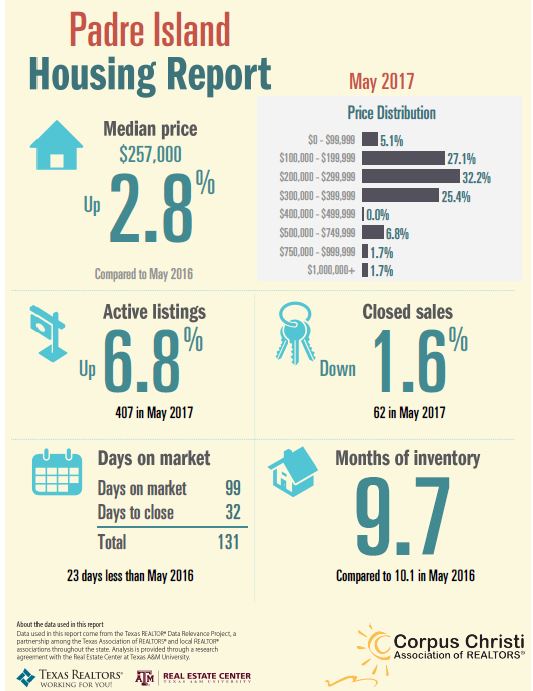

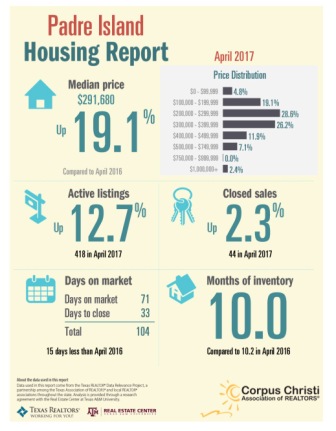

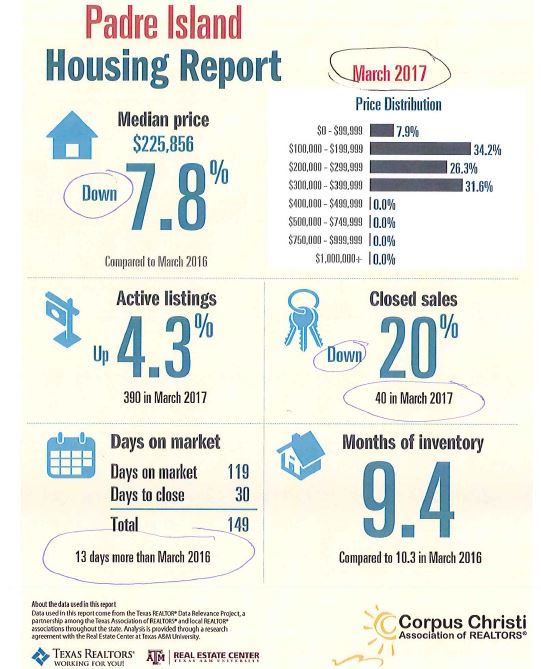

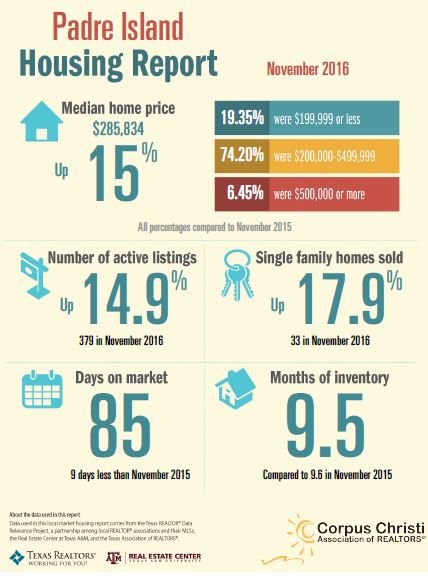

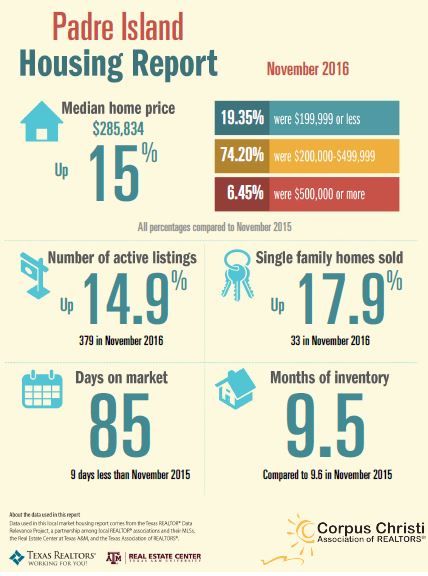

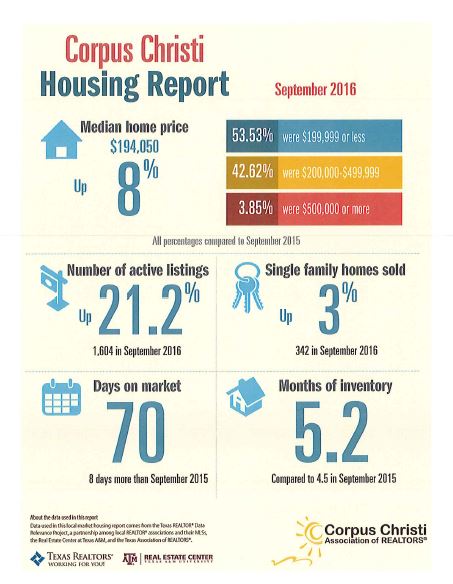

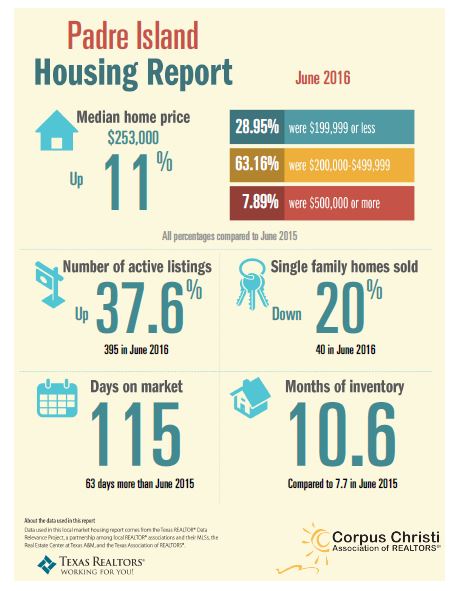

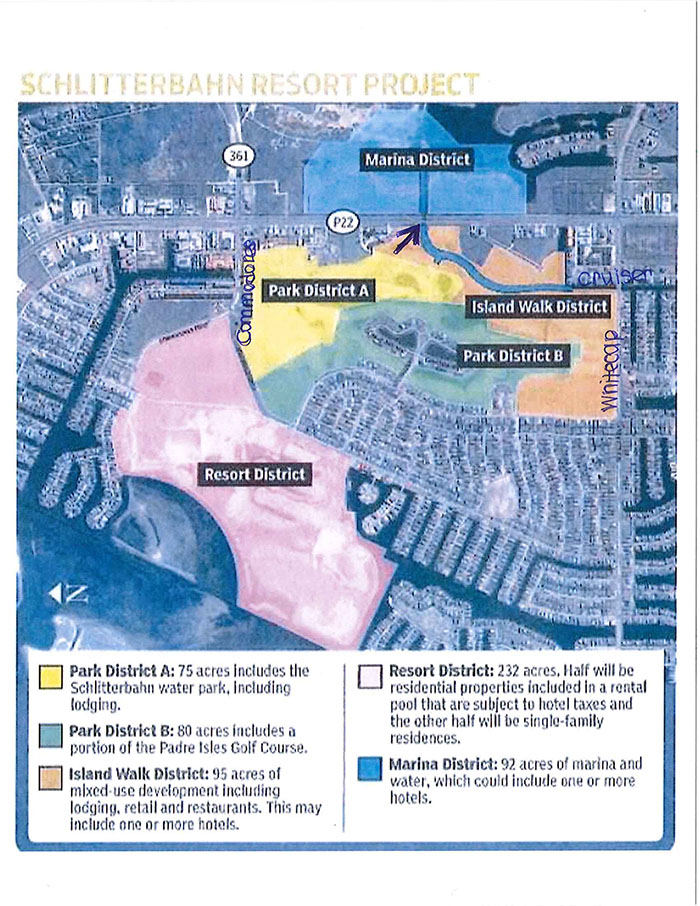

Padre Island Corpus Christi

Padre Island Corpus Christi Bang for your buck

Bang for your buck

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie!

I, for one, admire Winter Texans. They’ve got the right idea: Come to our piece of paradise, spend a few months, spend a few bucks, then repeat! Some come in RVs, others have a home/townhome/condo to which they retreat. The time is coming to welcome our Winter Texans back, and it’s the Winter Texan “way” that reminds me of one powerful investment tool – real estate of course! We are lucky enough to live in a place where many come to vacation. Whether you live here and want to capitalize on the growing rental market, or you’ve got relatives and friends to whom you’d love to persuade to do the same or invest in a vacation home…Get your own piece of Padre Island Pie!

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

It’s hot here on Padre Island, and I’m not talking just the high temperatures. It is real estate’s steamy season, and properties are being listed and sold faster than season tickets at the ‘bahn. With the active market, it’s critical to take a look at your spending. How can you be assured you’re not wasting money? Here are some smart tips on how to save and spend during peak purchase season. Do not fall victim to these common money mistakes.

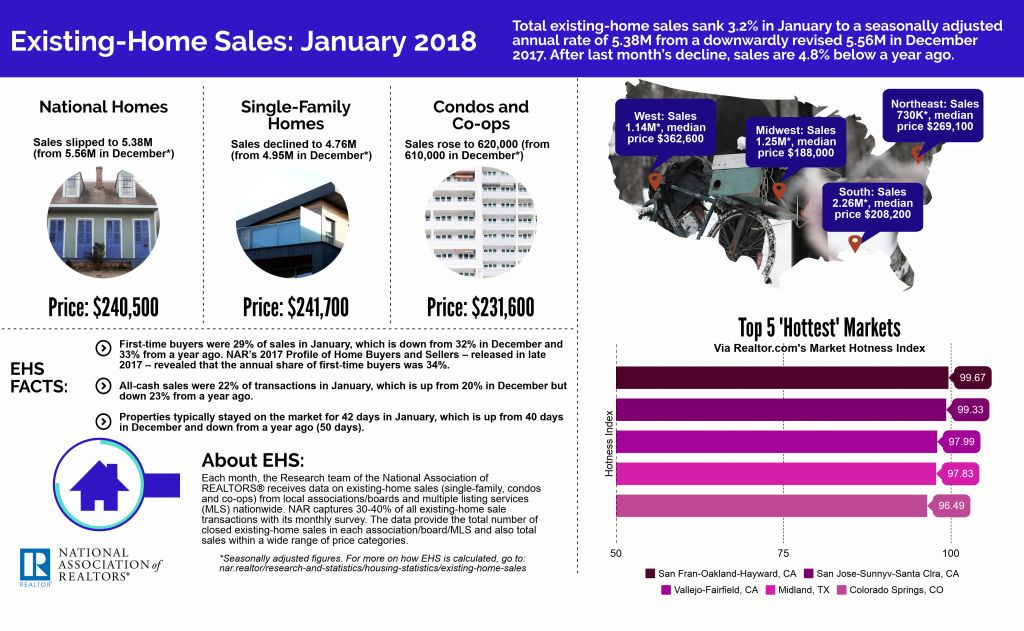

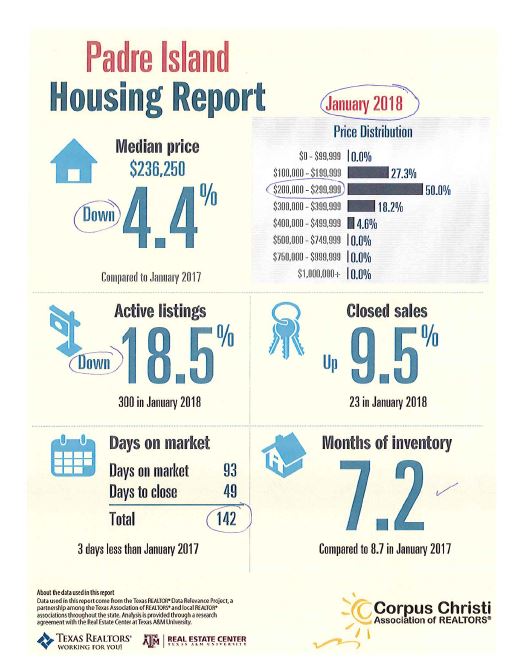

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Summer may be real estate’s busy season, but winter offers great opportunities for buying a house, especially for

Here is our top 6 tips for the New Year

Here is our top 6 tips for the New Year

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

These dwellings are having their shining moment, thanks to an increased demand by both first-time buyers and Boomers alike! Both appear to be seeking the appeal for walkable communities in which the amenities are grand, you can get a great bang for your buck, and often less maintenance (big perk for both busy, young families and Boomers alike!).

With the flooding and other tragedies that have occurred across the state, it is important that consumers be aware of Chapter 57 of the Texas Business and Commerce Code that was enacted by HB 1711 effective September 1, 2011. The bill applies to contractors who remove, clean, sanitize, demolish, reconstruct, or otherwise treat improvements to real property as a result of damage or destruction to that property caused by a natural disaster. Specifically, it requires that a “disaster remediation” contract must be in writing and prohibits a “disaster remediation contractor” from requiring payment prior to beginning work or charging a partial payment in any amount disproportionate to the work that has been performed. However, the statute exempts contractors that have held a business address for at least one year in the county or adjacent county where the work occurs.

With the flooding and other tragedies that have occurred across the state, it is important that consumers be aware of Chapter 57 of the Texas Business and Commerce Code that was enacted by HB 1711 effective September 1, 2011. The bill applies to contractors who remove, clean, sanitize, demolish, reconstruct, or otherwise treat improvements to real property as a result of damage or destruction to that property caused by a natural disaster. Specifically, it requires that a “disaster remediation” contract must be in writing and prohibits a “disaster remediation contractor” from requiring payment prior to beginning work or charging a partial payment in any amount disproportionate to the work that has been performed. However, the statute exempts contractors that have held a business address for at least one year in the county or adjacent county where the work occurs.

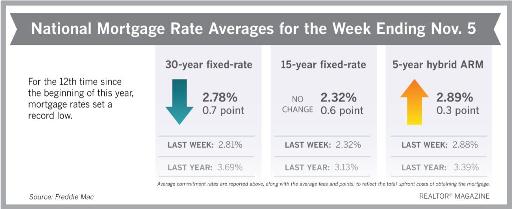

CORPUS CHRISTI – Plunging oil prices may be a relief for Coastal Bend residents at the pumps, but they’re having little influence on rents or mortgage payments.

CORPUS CHRISTI – Plunging oil prices may be a relief for Coastal Bend residents at the pumps, but they’re having little influence on rents or mortgage payments.

On Thursday, February 13th, at the Padre Island Business Association lunch, Jeff Shea, Site Manager for M&G Chemicals, spoke to update us on the M&G Chemicals PET/PTA Facility.

On Thursday, February 13th, at the Padre Island Business Association lunch, Jeff Shea, Site Manager for M&G Chemicals, spoke to update us on the M&G Chemicals PET/PTA Facility.

The effects of the government shutdown are rippling through the real estate industry, and practitioners are feeling the pain all over the country. Most of the complaints we’re fielding are about USDA loans, which have been entirely frozen. Real estate pros are seeing deals fall apart, as the Department of Agriculture has shuttered its mortgage division during the shutdown.

The effects of the government shutdown are rippling through the real estate industry, and practitioners are feeling the pain all over the country. Most of the complaints we’re fielding are about USDA loans, which have been entirely frozen. Real estate pros are seeing deals fall apart, as the Department of Agriculture has shuttered its mortgage division during the shutdown.